This is where TaxTools AI comes into the picture; being a modern, free and easy-to-use tool, TaxTools AI can help people, freelancers and professionals to estimate their income taxes and the net pay in the United States properly.

TaxTools AI delivers a high-quality premium experience to those who read The Tradable and appreciate the power of transparent and smart financial decisions without the complexity and cost of tax software.

What Is TaxTools AI?

TaxTools AI is a robust web based tool which offers an entire suite of U.S. salary and tax calculators. It also acts as a US salary calculator, free tax calculator, state tax calculator, income tax calculator, paycheck calculator and general tax estimator all in one. Faster and more precise, the platform enables users to determine their federal and state taxes in real time, with current tax rates and deduction logic.

Incentives TaxTools AI, in essence, is an AI tool that seeks to answer a single key question: How much money will I actually take home after taxes? The tool divides income into straightforward categories, which enable the user to know the way his/her money is spent and the impact of taxes on the income.

Why Accurate Salary and Tax Calculations Matter

Many people rely on rough estimates or outdated calculators when evaluating job offers or planning monthly budgets. This often leads to unrealistic expectations and financial stress. Accurate paycheck calculations are essential for:

- Comparing job offers across different states

- Planning monthly expenses and long-term savings

- Negotiating salaries with confidence

- Understanding how deductions and filing status affect take-home pay

TaxTools AI eliminates guesswork by delivering precise results based on current federal and state tax structures. Whether you are a salaried employee, hourly worker, or self-employed professional, the platform adapts to your situation.

Key Features of TaxTools AI

1. Free and Instant Results

TaxTools AI is completely free to use. There is no account registration, no hidden fees, and no learning curve. Users simply enter their salary details and receive instant results.

2. Federal and State Tax Accuracy

The platform calculates federal income tax alongside state-specific taxes, making it a reliable tax tool online solution. This is especially useful in states with complex or progressive tax systems.

3. Clear Paycheck Breakdown

Each calculation includes a detailed breakdown of gross income, federal tax, state tax, deductions, and final net pay. This clarity helps users understand exactly how their paycheck is structured.

4. Designed for Real-World Use

TaxTools AI is built for everyday financial decisions, not just annual tax filing. It is ideal for budgeting, salary planning, and income forecasting throughout the year.

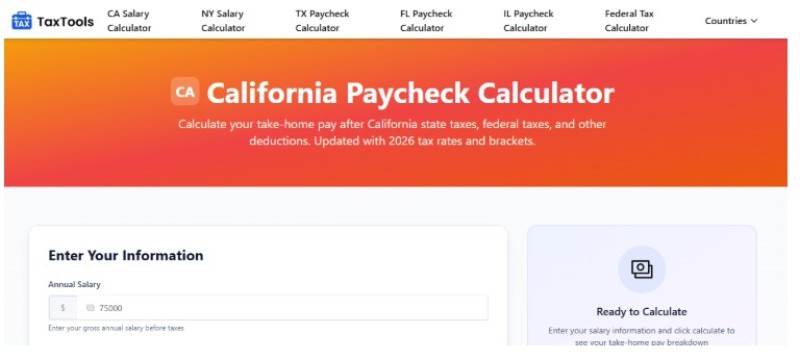

California Paycheck Calculator: Know Your Take-Home Pay in CA

California is known for its higher state income tax rates, which makes accurate paycheck calculation especially important. TaxTools AI offers a dedicated California paycheck calculator that reflects California’s tax structure and current withholding rules.

With this tool, users can calculate their California take-home pay using updated state tax rates, federal withholding, and deductions. It works as a California salary calculator, CA tax calculator, California income tax calculator, and california take home pay calculator all in one.

This calculator is particularly useful for professionals relocating to California, remote workers comparing offers, or residents who want a clearer view of their monthly income.

New York Paycheck Calculator: Accurate Results with State and Local Taxes

Beyond California, TaxTools AI also delivers precise salary calculations for New York residents and professionals considering jobs in the state. The New York paycheck calculator is designed to factor in New York State income tax along with local taxes, including those imposed by New York City and Yonkers. These local withholdings can noticeably reduce take-home pay, making accurate calculation essential.

Whether users are looking for a New York salary calculator, NY tax calculator, NYC paycheck calculator, NY take-home pay calculator, or Yonkers tax calculator, TaxTools AI provides dependable estimates based on current tax rates, federal withholding rules, and applicable deductions. This ensures users have a clear understanding of their net income before accepting an offer or planning their finances.

Who Can Benefit from TaxTools AI?

TaxTools AI is planned to be used by a wide audience of customers who have various financial requirements. It is especially handy when an expert is comparing employment opportunities or budgeting a pay raise, freelancers and contractors calculate the current tax payments, and remote workers gauge disparities in incomes between states. The students and fresh graduates joining the workforce can also count on the platform to know their first paychecks with confidence.

TaxTools AI is user-friendly and can be easily used by a beginner, yet still provides the accuracy that financially advanced users would typically expect. It is a convenient alternative to those who need to know their income and taxes reliably but do not need an unjustified complications.

TaxTools AI vs Traditional Tax Software

Unlike full tax-filing software that requires extensive personal data and long setup processes, TaxTools AI focuses on quick, actionable insights. It does not replace professional tax filing, but it excels at what most people need daily: understanding net income.

Key advantages include:

- Faster calculations

- No registration required

- Easy-to-read results

- Optimized for salary and paycheck estimation

This makes TaxTools AI a practical tool for ongoing financial planning rather than a once-a-year solution.

Final Thoughts

The key to making smart financial choices is to know your actual income. TaxTools AI is a high-quality, free, and easy-to-use solution that allows one to compute federal and state taxes, determine how much he or she can take home, and spend money wisely. In addition to a strong US salary calculator and state-specific models such as the California paycheck calculator, the site has all that you need to view the entirety of your pay.

Tax Tools AI is an excellent online tax calculator tool that can be highly recommended to every person who appreciates accuracy, speed, and transparency, and builds a tool that will suit their modern needs.

Editorial staff

Editorial staff

Editorial staff

Editorial staff