If you rely on your vehicle for work or business purposes, understanding the IRS mileage rate in 2025 is critical for optimizing your tax deductions and managing costs. Each year, the IRS reviews and adjusts the standard mileage rate to reflect changes in fuel prices, vehicle maintenance costs, and economic trends. For 2025, several key updates may affect how individuals and companies report vehicle-related expenses.

What Is the IRS Mileage Rate?

The IRS mileage rate is a standardized deduction rate that taxpayers can use to calculate the deductible costs of operating an automobile for business, medical, moving, or charitable purposes. It simplifies tax reporting by offering a per-mile rate instead of requiring detailed tracking of all actual vehicle expenses.

Purpose-Based Breakdown

- Business use: Deduct miles driven for client meetings, business trips, or errands.

- Medical use: Deduct mileage driven for healthcare visits.

- Moving purposes: Eligible for certain active-duty military members.

- Charitable use: Mileage related to volunteer work.

IRS Mileage Rate in 2025: Official Figures

For the 2025 tax year, the IRS has set the following mileage rates:

- Business miles: 67 cents per mile

- Medical and moving miles: 22 cents per mile

- Charitable miles: 14 cents per mile (fixed by law, unchanged)

These rates reflect trends in gas prices, inflation, vehicle depreciation, and maintenance costs. The IRS typically announces updated mileage rates in December of the prior year, so these 2025 figures were likely released in December 2024.

How the Mileage Rate Affects You

For Self-Employed Individuals

Freelancers, contractors, and gig economy workers can deduct business mileage using the standard IRS mileage rate in 2025. Keeping accurate records is essential.

For Employees

Following the Tax Cuts and Jobs Act (TCJA), unreimbursed employee expenses (including mileage) are not deductible for most workers. However, some exceptions apply to certain professions.

For Businesses

Businesses can reimburse employees using the IRS rate. This reimbursement is considered nontaxable income, provided it doesn’t exceed the IRS-approved rate.

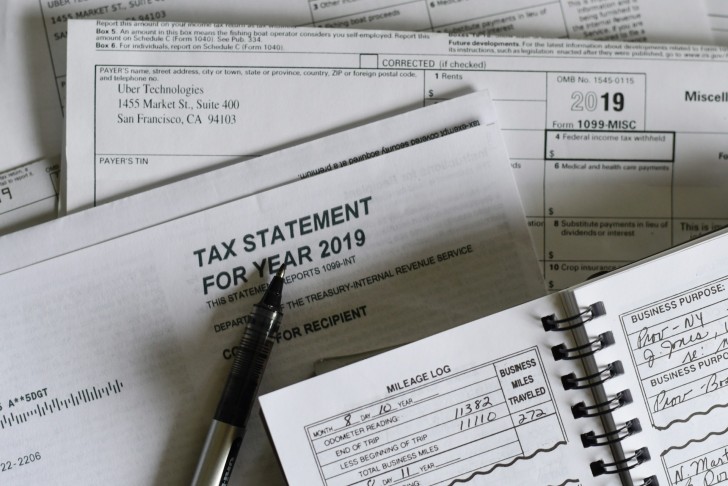

How to Track Mileage in 2025

Accurate tracking is essential to claim the IRS mileage rate. Your records should include:

- Date of the trip

- Purpose of the trip

- Total miles driven

- Starting and ending locations

Recommended Tools for Tracking

- Everlance

- MileIQ

- QuickBooks Self-Employed

- Manual logs (spreadsheet or journal)

Can You Deduct Actual Vehicle Expenses Instead?

Yes. Taxpayers can choose between:

- Standard mileage rate – Simple, requires only mileage tracking.

- Actual expense method – Involves calculating gas, oil, maintenance, insurance, and depreciation.

Tip: Once you use the actual method for a leased vehicle, you must continue doing so for the entire lease term.

Common Mistakes to Avoid

- Double-dipping: You can't claim both the mileage rate and actual expenses.

- Commuting miles: Daily commute mileage is not deductible.

- Poor recordkeeping: Incomplete logs can trigger IRS audits.

Audit-Proofing Your Deduction

- Use IRS-compliant tracking apps.

- Keep logs for at least 3 years after filing.

- Save fuel receipts and maintenance records even if you use the standard rate.

Bonus Tip: Maximizing the Deduction

If you’re self-employed, combine your IRS mileage deduction with:

- Home office deduction (if applicable)

- Depreciation on owned vehicles (if using actual expenses)

- Tolls and parking fees (can be added separately to mileage deductions)

Final Thoughts

Whether you're a solopreneur, a business owner with a mobile team, or someone who volunteers extensively, the IRS mileage rate in 2025 offers a streamlined way to reduce your taxable income. Understanding how it works—and keeping bulletproof mileage logs—can lead to significant savings come tax time.

Stay tuned as we explore other topics, including how apps like Everlance and QuickBooks Self-Employed can help streamline mileage tracking in 2025

Editorial staff

Editorial staff

Editorial staff

Editorial staff