- Why Tracking Currency Exchange Rates Manually Doesn’t Work Anymore

- What You Need to Track Currency Exchange Rates Automatically

- How a Live Exchange Rates API Works (Simple Explanation)

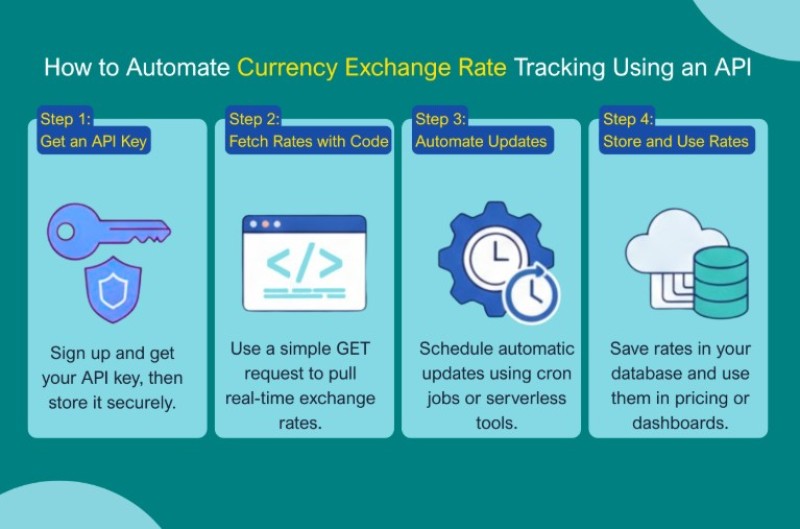

- Step-by-Step: How to Automate Currency Exchange Rate Tracking Using an API

- Example Workflow: How Businesses Actually Use Automated Rates

- Common Mistakes When Automating Currency Exchange Rates

- Conclusion:

- FAQs:

Keeping up with exchange rates manually is slow and unreliable. Rates move constantly, and even small delays can affect pricing, invoices, or financial reports.

A currency exchange rate is the value of one currency compared to another. And because this value changes minute by minute, automation is the only way to keep your data accurate.

In my experience working with developers and finance teams, the biggest challenge isn’t understanding the numbers. It’s making sure those numbers are always fresh. That’s where automation and a live exchange rates API make a noticeable difference.

This guide walks you through how these APIs work, why manual tracking fails, and how you can automate updates with a simple setup.

Why Tracking Currency Exchange Rates Manually Doesn’t Work Anymore

Most teams start by checking a few websites, copying numbers, and pasting them into a spreadsheet or dashboard. It works for a day or two. Then the problems show up.

Exchange rates change fast. A single spike can shift the value of a currency pair within seconds. And when you depend on manual updates, those changes arrive too late. In my experience, businesses usually don’t notice the impact until they compare their recorded rate with the actual mid-market rate hours later.

Manual tracking also creates inconsistency. Different websites use different data sources, update schedules, and rounding rules. So the rate you pulled in the morning might not match the rate you check an hour later. That small gap turns into real money when you’re handling payments, invoices, or multi-currency pricing.

There’s also the human side. People get busy. Data gets missed. A spreadsheet doesn’t refresh itself. When the wrong rate slips through, it affects payouts, revenue calculations, and financial accuracy.

Automation fixes all of this. It pulls data from one reliable source, updates it on a schedule, and removes the gaps that manual work always creates.

What You Need to Track Currency Exchange Rates Automatically

You don’t need a complex setup to automate exchange rate updates. A few core pieces are enough to keep your data accurate without touching spreadsheets or refreshing websites.

In my experience, most developers start with the same basic toolkit:

1. A Live Exchange Rates API

This is the source of truth. An API gives you real-time currency data in a consistent format, usually JSON. It removes guesswork and eliminates differences between websites.

2. An API Key

Every reliable provider uses keys for authentication. It tells the system who you are and prevents abuse or random access.

3. The Currencies You Want to Track

You’ll set a base currency (like USD) and a list of target currencies (EUR, GBP, JPY, or whatever you need). This helps your script fetch only what matters.

4. A Way to Schedule Updates

Automation depends on timing.Most teams use:

- cron jobs

- serverless scheduled functions

- background workers

Anything that can run a task every minute, hour, or day works fine.

5. A Place to Store the Updated Rates

You can save the data to:

- a database

- a cache layer

- a pricing engine

- or even a local file for simple setups

Storing rates ensures your app doesn’t call the API every time it needs a value.

Once these pieces are in place, tracking exchange rates becomes hands-off. The API sends fresh data, your script saves it, and everything stays accurate on its own.

How a Live Exchange Rates API Works (Simple Explanation)

A live exchange rates API gives you updated currency values the same way weather apps give you live forecasts. You request the data, and the API sends back the latest numbers. It’s straightforward once you see how the pieces fit together.

In my experience, developers usually start by testing a simple request. You send a call to the API endpoint with your base currency, and the service returns a list of converted values. The response format is almost always JSON because it’s easy to parse in any programming language.

Here’s what the flow looks like:

1. You send a request

Your script makes an HTTP GET request to the API:

- includes your API key

- sets the base currency

- asks for specific target currencies or all available currencies

2. The API fetches the latest market rate

Behind the scenes, the provider aggregates data from:

- forex markets

- financial institutions

- central bank sources

You don’t see this process, but it’s why the numbers update frequently.

3. You receive a JSON response

The API responds with the current rate. It usually includes:

- timestamp

- base currency

- List of target currencies

- mid-market exchange rate

Example response (simplified):

{ "base": "USD", "date": "2025-01-21", "rates": { "EUR": 0.92, "GBP": 0.78, "JPY": 149.21 }}

4. Your system reads and saves the numbers

You can push the data into a database, a cache layer, or any pricing logic you use.

5. A scheduler repeats the process automatically

A cron job or serverless function runs this request every hour or every minute—whatever you need.

This is the full cycle. Once it's set up, the API keeps delivering current data, and your system never falls behind. It removes both delay and human error from your workflow.

Step-by-Step: How to Automate Currency Exchange Rate Tracking Using an API

Automation sounds complicated, but the workflow is simple once you break it down. In my experience, most developers follow the same four steps: get an API key, fetch the data, schedule updates, and store the results. That’s it.

Below is the full process in a clean, practical format.

Step 1: Get an API Key

To start, you need access to a reliable data source. A good API provides real-time rates, clear documentation, and stable uptime.

You can get one from the Free Currency Converter API; it’s straightforward and gives you consistent, accurate exchange rates for automation setups.

Once you have the API key, keep it private and store it as an environment variable.

Step 2: Fetch Live Exchange Rates Programmatically

You can call the API with a simple HTTP request.Here’s a basic example in JavaScript (Node.js):

var request = require('request');var options = { 'method': 'GET', 'url': 'https://api.currencyfreaks.com/v2.0/fluctuation?startDate=2022-10-01&endDate=2022-10-15&symbols=pkr,eur,gbp,cad&base=usd&apikey=YOUR_APIKEY', 'headers': { }};request(options, function (error, response) { if (error) throw new Error(error); console.log(response.body);});

What this script does:

- Sends a GET request

- Uses your API key

- Pulls the latest exchange rates

- Prints them to your console

You can adjust the base currency or add specific symbols as needed.

Step 3: Schedule Automatic Updates

Once your request works, the next step is setting a schedule.

Common options developers use:

- Cron jobs → run every X minutes/hours.

- Serverless functions (AWS Lambda, GCP Cloud Scheduler)

- Background workers (Bull queue, Celery, etc.)

Example cron patterns:

- Every hour: 0 * * * *

- Every 10 minutes: */10 * * * *

The scheduler will call your script automatically, so your rates are always fresh.

Step 4: Store and Use the Updated Rates

Storing the rates prevents unnecessary API calls and keeps your system fast.

Most teams save the rates to:

- a database (PostgreSQL, MySQL, MongoDB)

- a cache layer (Redis)

- a pricing engine or billing module

- local storage for lightweight apps

This lets your application use the latest values instantly without fetching them every time.

Example structure to store:

timestampbase_currencytarget_currencyratesource

Once stored, your pricing logic, invoices, dashboards, or reports can pull the correct values automatically.

Example Workflow: How Businesses Actually Use Automated Rates

Once you automate exchange rate updates, the data becomes a steady part of everyday operations. In my experience, most companies follow a simple workflow: fetch the rate, store it, and use it wherever money or pricing is involved. Different industries use the same data in different ways, but the goal is always accuracy.

Here are some real examples of how teams rely on automated exchange rates.

E-commerce Platforms

Online stores selling in multiple currencies need accurate prices at all times. If the rate shifts, the displayed price updates automatically. No manual edits. No unexpected losses.

SaaS and Subscription Billing

Many SaaS platforms bill users globally. Automated rates help them convert USD to EUR, GBP, AUD, or any local currency without overcharging or undercharging customers.

Fintech Dashboards & Wallets

Apps that show balance values in different currencies rely on updated rates to keep numbers honest. A small delay can cause visible inconsistencies for users.

International Payroll & Accounting

Teams paying contractors across multiple countries need stable, consistent conversions. Automated rates reduce disputes and help accounting teams stay compliant.

Summary Table: How Different Businesses Use Automated Rates

| Industry | How Automation Helps | Result |

| E-commerce | Updates product prices in real time | More accurate multi-currency checkout |

| SaaS Billing | Converts subscription prices automatically | Fewer billing errors |

| Fintech Apps | Powers dashboards and live balances | Consistent user experience |

| Global Payroll | Converts payouts without manual checks | Accurate salary calculations |

| Accounting | Keeps records aligned with real rates | Clean, compliant reporting |

Automation isn’t just a convenience here. It removes the biggest source of errors: human delays. And once it’s in place, every part of the system benefits from having the most current numbers available instantly.

Common Mistakes When Automating Currency Exchange Rates

Even with a good API, automation can break if the setup has small gaps. In my experience, most problems come from how the data is stored or refreshed, not from the API itself. These are the issues developers run into most often.

1. Not Caching API Responses

Some systems call the API every time they need a rate. This slows everything down and can hit rate limits quickly. Caching solves both problems by storing the latest rate temporarily.

2. Using Daily Rates for Real-Time Needs

Daily rates are fine for accounting or end-of-day summaries. They aren’t suitable for pricing, payments, or any workflow that reacts to market movement. If the value changes throughout the day, your numbers will drift.

3. Ignoring API Errors or Timeouts

APIs occasionally return errors or take too long to respond. If your code doesn’t check for this, it may store a bad value or overwrite a good one with nothing.

4. Storing Only the Final Converted Value

Some systems save just the converted number. Without the actual exchange rate used, it becomes impossible to verify or audit transactions later.

5. Forgetting to Schedule Updates Properly

A script might run daily when it should run hourly. Or it runs hourly when traffic spikes demand faster updates. A mismatched schedule leads to stale data and inconsistent calculations.

These issues are simple to fix once identified. A clean setup with caching, proper scheduling, and error handling keeps exchange rate automation reliable for the long term.

Conclusion:

Automating currency exchange rate tracking with an API makes managing global pricing simple and reliable. Instead of manually checking rates or relying on spreadsheets, a live exchange rates API keeps your data accurate, up to date, and ready to use across your apps, dashboards, or financial systems.

By integrating automation into your workflow, you reduce errors, save time, and ensure that every calculation from pricing to invoicing is based on the most current rates. Using a free, reliable API like currencyFreaks.com gives you a scalable solution that grows with your business while keeping your exchange rate data precise and consistent.

FAQs:

How do I get live currency updates? You get live updates by connecting to a currency exchange rate API programmatically. Set up a scheduled task, like a cron job, serverless function, or background worker, to fetch the latest rates automatically at the interval you need.

How often are exchange rates updated? Most real-time APIs refresh continuously or several times per hour, ensuring you always have the latest market data. You can control how frequently your system fetches the rates to balance accuracy with API usage limits.

Is there a free API available?

Yes. currencyfreaks.com offers a free currency converter API that provides real-time exchange rates and supports automated updates. It’s ideal for testing, development, or low-volume production needs. Higher-tier plans unlock more requests and advanced features if your usage grows.

Editorial staff

Editorial staff

Editorial staff

Editorial staff