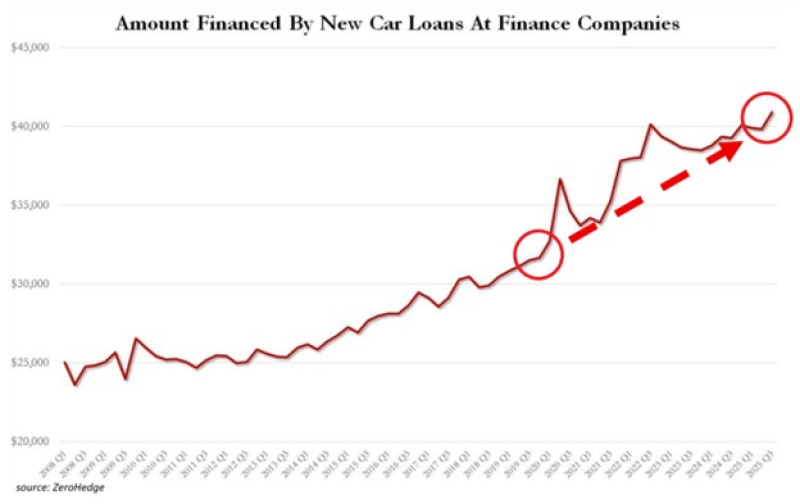

⬤ Buying a new car in America now costs more than ever. The average loan reached a record $41,000, while the typical new vehicle price stands near $50,000 according to Kelley Blue Book. When we examine the figures for the past ten years, we see a sharp rise that became especially steep after 2020, the year when financed amounts began to surge.

⬤ In 2010 the average car loan was about $25,000. That same figure exceeds $40,000. The steepest climb began right after early 2020; within a few years the average loan rose by $9,000, a jump of 28 percent. During October alone, Americans added four billion dollars in fresh auto debt lifting the nationwide total to a record 1.56 trillion dollars.

⬤ The larger loans do not simply reflect a taste for luxury vehicles - they show that vehicle prices have soared and that more buyers must finance almost the entire cost. Premium brands like Tesla feel this pressure acutely, because their higher window prices force customers to depend even more heavily on loans. As loan balances keep rising, they alter both shopping behavior and the range of vehicles buyers can truly afford.

⬤ The trend matters because when Americans push car debt to the limit, the entire market turns fragile. Larger loan balances leave drivers more vulnerable to rate increases and to any economic slowdown. The relentless rise in financed amounts signals that affordability has become a serious issue, one likely to reshape purchase patterns in the coming year.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi