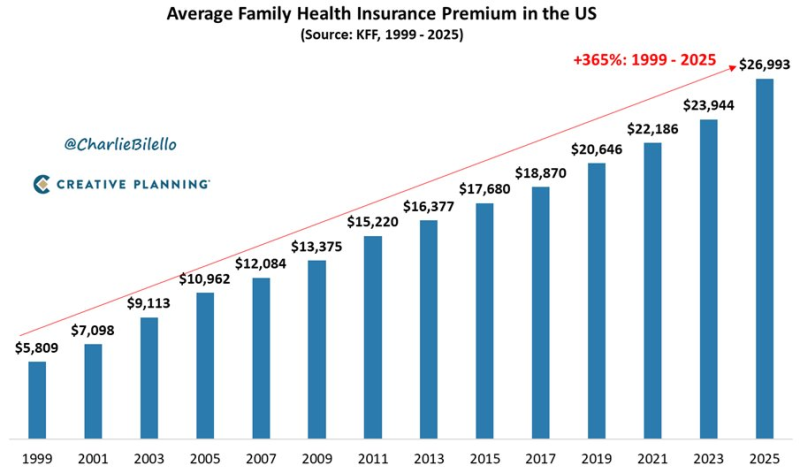

● U.S. health insurance costs have jumped more than 26% over the past five years. Data compiled by CharlieBilello from the Kaiser Family Foundation shows average annual family premiums hit $26,993 in 2025, up from about $21,500 in 2020 and just $5,809 in 1999—a 365% increase over 26 years.

● This trend has sparked fresh debate over healthcare taxation and benefits. Some policymakers are considering tax reforms targeting employer-provided health benefits to address budget shortfalls. But the risks are real: small and mid-sized businesses could face higher costs, potentially leading to bankruptcies or reduced employee coverage. Rising insurance expenses may also drive workers away from labor-intensive industries as employers struggle to balance wages with mounting benefit costs.

● Financially, analysts predict rising healthcare costs could drain corporate and household budgets by hundreds of billions over the next decade. While some officials support cutting health-related tax deductions to control spending, industry groups warn this could stifle innovation and worsen affordability. As an alternative, experts propose modest tax increases on high-margin pharmaceutical and insurance companies to help stabilize premium growth while maintaining government revenue.

Peter Smith

Peter Smith

Peter Smith

Peter Smith