⬤ The U.S. equity market showed improving internal strength despite turbulence across several sectors. Investors were fixated on AI winners and losers while crypto and precious metals pulled back — yet the broader market was quietly gathering momentum. The Dow Jones Industrial Average hit the 50,000 milestone during this same stretch.

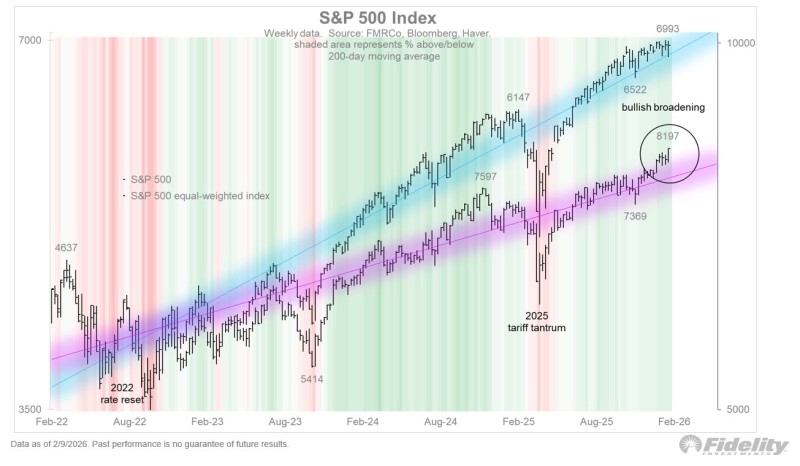

⬤ A key chart comparing the S&P 500 (SPX) with its equal-weighted version tells the real story. The equal-weighted index — which treats every stock the same regardless of market cap — has started catching up after lagging for much of the earlier rally. That's a clear sign the gains are spreading beyond a handful of heavyweight names.

⬤ Sector rotation is driving the narrative. Money has been moving out of dominant AI-related equities and into other parts of the market, while digital assets and metals gave back gains. This shift connects directly to SP 500 tech valuations drop forward PE falls below 30 over 5 years — valuation compression in big tech doesn't have to mean market weakness when capital finds new homes elsewhere.

⬤ The broadening of gains beyond a narrow group of leaders often marks a meaningful transition in the market cycle. When more stocks participate in a rally, it tends to signal improving stability and a healthier foundation — setting the stage for what comes next in the trend.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah