Put/Call Ratio Market Is In Bubble Territory

Callum Thomas, the head of research at the Topdown Charts, shares his observations about the options and stock market in a series of tweets.

"…call buyers still storming along, pushing the put/call ratio further to the extremes..." Callum Thomas via Twitter

Put / Call Ratio is a simple indicator that helps to analyze market dynamics. It analyzes the relationship between the put and call options. The higher the ratio, the more put options are there on the market, and, consequently, the higher the desire to sell assets.

Now the market is already in a bubble territory, according to this indicator, since the ratio is extremely low, but the market continues to grow.

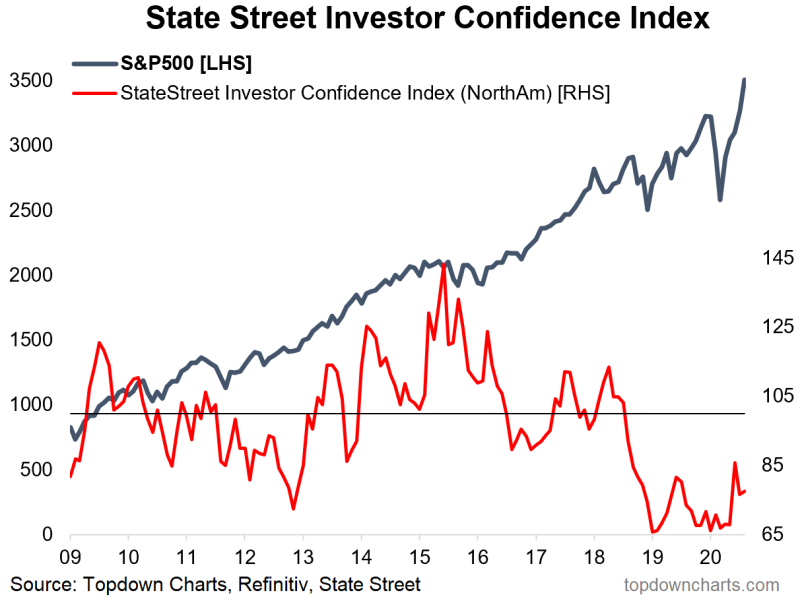

Investor Confidence Index Did Not Grow Along With the SPX

However, there are market participants who, apparently, do not share the general sentiment.

"Despite the growing (retail) optimism, State Street's data shows institutional investors are still skeptical: North America Investor Confidence index still below 100"

Confidence index analyzes the actual buying and selling patterns of institutional investors, its value is still below the data from 2018-2019, the growth this month was not as significant as the rise of the S&P 500, which has been growing for a record 5 months in a row.

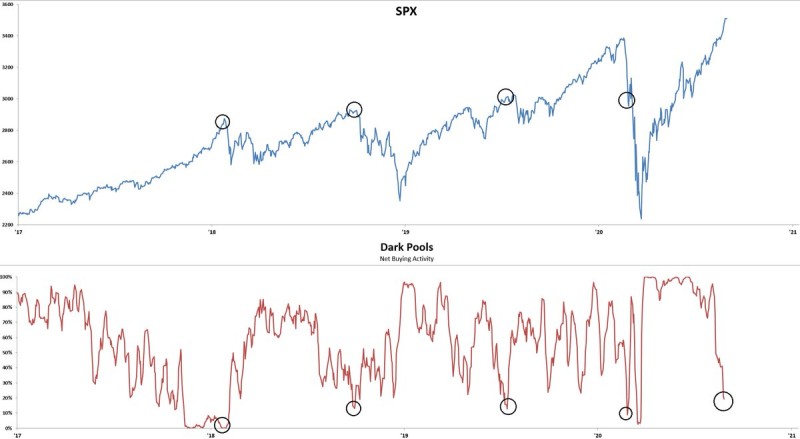

Dark Pool Activity Is Low

Moreover, Dark Pool activity has also decreased, according to Callum Thomas.

"Back on the big boys, Dark Pool buying activity has dried up. Correction risk flag waving?" Callum Thomas via Twitter

Dark Pool allows big institutional investors to buy and sell without being exposed right until after the operation has been completed. This helps them place large orders without revealing their intentions.

This indicator is important because it shows the attitude of the major players towards the market. As a rule, they are the ones who set the trend, buying and selling large amounts of assets worth billions of dollars. If they show no interest in buying the stock further, the bullish trend could turn into a bearish one.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov