Solana just had a pretty solid day, jumping 5.08% from $162 support all the way up to $171. But here's the thing - it wasn't just the price that caught everyone's attention. Trading volume absolutely exploded, shooting up 23.54% to hit $4.94 billion. That kind of volume spike usually means one thing: serious money is flowing in.

So what's really driving this rally? It's actually a perfect storm of whale activity, retail traders jumping in, and some technical signals that have people talking.

Whale Drops $12M on SOL Tokens

Here's where things get interesting. According to Lookonchain, some whale just scooped up 71,000 SOL tokens worth about $12 million straight from Binance. But they didn't just leave it sitting there - they moved the whole stack to Kamino, probably to earn some yield.

Now, when whales move their coins from exchanges (where they can easily sell) to DeFi protocols (where they're locked up), that's usually a good sign. It means they're not looking to dump anytime soon. They're actually betting on SOL going higher while making some extra cash on the side.

This kind of move shows real confidence. You don't lock up $12 million unless you think the price is heading up.

Retail Traders Are All In on SOL Price

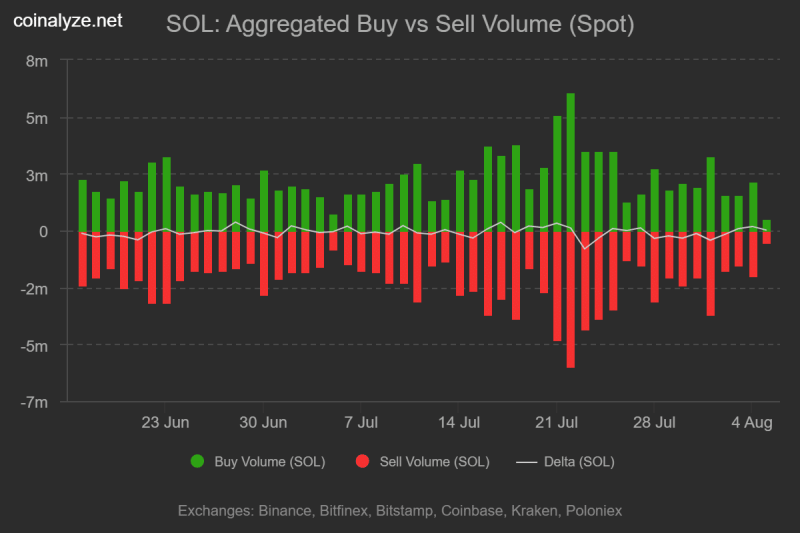

The big players aren't the only ones buying. Regular traders have been piling in too. For three straight days, Solana's been seeing more buying than selling, with Buy-Sell Delta staying positive.

On August 5th alone, there was $553K in buy volume versus just $532K in sell volume. That $21K difference might not sound huge, but it shows people are consistently accumulating.

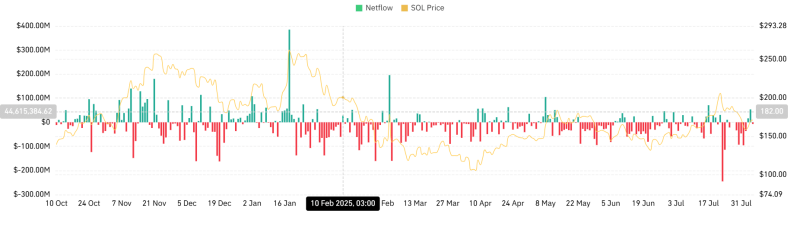

Even better, Solana's Spot Netflow went negative at -$6.86 million. Before you panic - that's actually bullish. It means more SOL is leaving exchanges than coming in. When people move their coins off exchanges, they're usually planning to hold, not sell.

Futures Traders Double Down on SOL

The futures market is telling the same story. Solana's funding rates have been positive all week, sitting at 0.0137 right now. When funding rates are positive, it means long traders are willing to pay short traders - basically, everyone wants to bet on SOL going up.

The numbers are pretty wild: over 79% of positions are long, with the 1-day ratio at 4.13. That means for every person betting against SOL, more than four people are betting it'll keep climbing.

Can SOL Hit $200?

Technically speaking, things are looking pretty good for SOL. The MA50 just crossed above the MA200 on the daily chart - that's called a golden cross, and it's usually a strong bullish signal.

Right now, SOL is testing resistance around $172 (the 20 EMA). If it can close above that level cleanly, the path to $200 opens up. But if it gets rejected here, we might see a pullback to around $162, where the 50 and 100 EMAs are sitting.

With whales accumulating, retail buying, and futures traders going long, SOL looks set up for more gains. The golden cross adds some technical backing to the bullish case. Just keep an eye on that $172 level - it's the key to unlocking the next leg higher.

Peter Smith

Peter Smith

Peter Smith

Peter Smith