Gold (XAU) is eyeing fresh all-time highs with WisdomTree targeting $3,850/oz by Q2 2026 in their base case, while an extreme "Mar-A-Lago Accord" scenario could send the precious metal soaring to $5,355/oz.

Gold (XAU) Consolidates Before Next Major Move

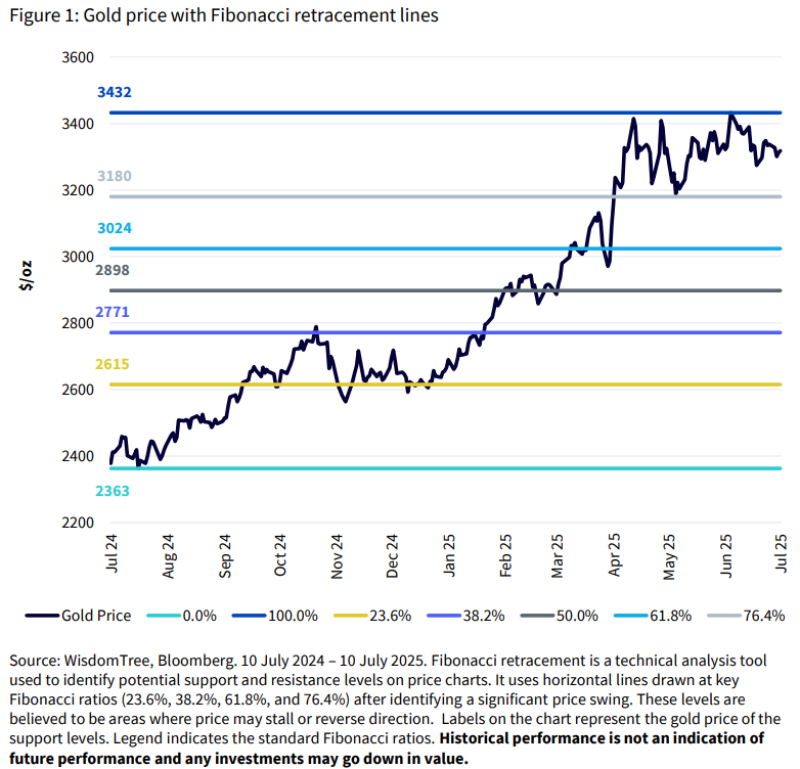

After hitting its all-time high of $3,500/oz back in April, gold has been stuck in a trading range between $3,180 and $3,400. But don't worry – this isn't a bearish sign. WisdomTree analysts see this as gold "loading the spring" before its next big push higher.

The current consolidation sits right at the 76.4% Fibonacci retracement level, which is providing solid support. Even if gold dips below this level short-term, analysts expect strong buying to kick in around $3,024/oz (the 61.8% Fibonacci level).

"We see the current period as a 'loading the spring' phase, setting the stage for a powerful upward movement in gold prices," WisdomTree explained. This sideways action often happens before explosive moves in precious metals.

Five Big Reasons Why Gold (XAU) Prices Are Heading Higher

WisdomTree has pinpointed five major macro factors that should drive gold to new highs over the next 18 months.

First up is trade uncertainty. Sure, Trump struck preliminary deals with China and the UK, but they're not as good as markets hoped and still include hefty tariff increases. Plus, negotiations with Canada, Mexico, and the EU are still dragging on. All this uncertainty typically sends investors running to gold.

Then there's America's debt problem – and it's getting ugly fast. The new One Big Beautiful Bill Act is adding $2.4 trillion to US deficits between 2025 and 2034, not even counting interest payments. When you factor those in, we're looking at over $3 trillion in additional debt. The debt-to-GDP ratio is jumping from 117.1% to 123.8% by 2034. Historically, when government debt spirals like this, gold prices follow suit.

The third worry is about the Fed's independence. Trump keeps bashing Fed Chair Jerome Powell, whose term ends in May 2026. This reminds analysts of the messy 1978-1979 period under G. William Miller, when institutional weakness and high inflation created perfect conditions for gold's historic gains. Back then, it took Paul Volcker's aggressive rate hikes – which triggered two recessions – to fix the damage.

Geopolitically, things aren't looking great either. Iran stopped cooperating with the International Atomic Energy Agency after US and Israeli strikes, and there are no diplomatic talks scheduled. Meanwhile, Trump's promise to end the Russia-Ukraine war in 24 hours crashed and burned, making relations with both Putin and Zelenskyy even worse.

Trump's Dollar Policy Could Send Gold (XAU) to $5,355/oz

The fifth and potentially biggest factor is Trump's unclear dollar policy. While there's no official plan to weaken the dollar, the administration's actions suggest they're going soft on the greenback.

WisdomTree cooked up a hypothetical "Mar-A-Lago Accord" scenario that could shock global markets. It's not their main prediction, but if Trump actually pursued deliberate dollar depreciation, gold would go ballistic – especially if people start doubting America's ability to pay its debts.

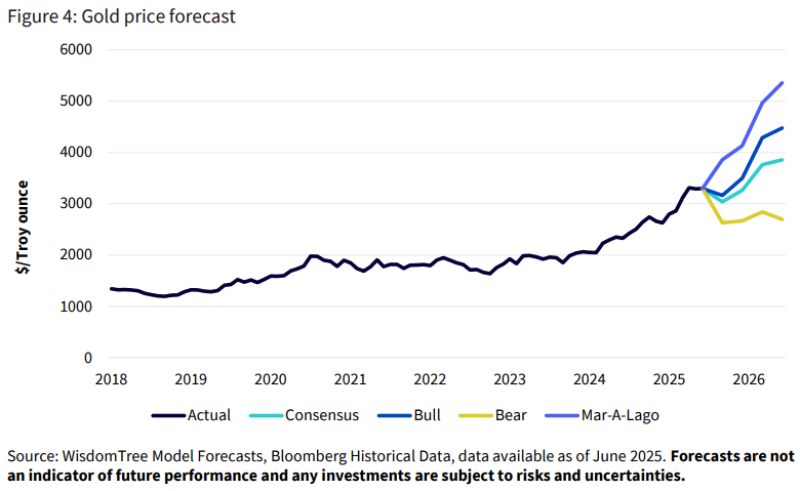

Here's how the different scenarios play out:

In the base case, gold should hit $3,850/oz by Q2 2026. This assumes inflation stays above the Fed's 2% target (thanks to tariffs), bond yields remain stable, and the dollar weakens modestly.

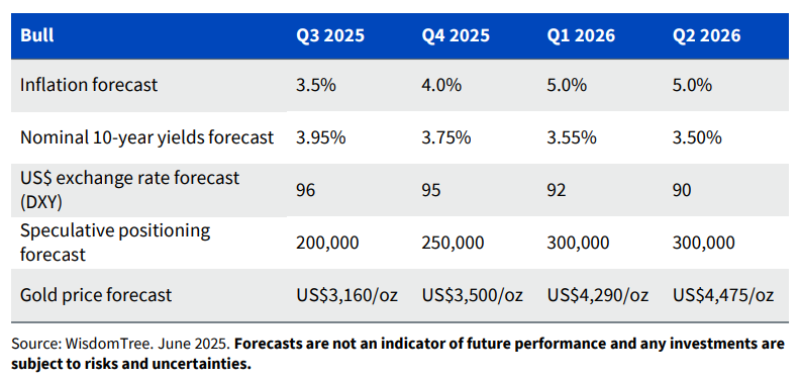

The bull scenario gets more exciting. If tariff shocks really hurt the economy and force the Fed to cut rates aggressively, gold could reach $4,475/oz by end of Q2 2026. More rate cuts would fuel inflation beyond what tariffs alone cause, weakening the dollar further.

Even in their bear case – where inflation drops to 2%, bond yields hit 6%, and the dollar strengthens – gold only falls to $2,700/oz, still well above where we started in 2025.

But the "Mar-A-Lago Accord" scenario is where things get wild. If Trump deliberately weakens the dollar by 23% over a year (similar to how the Plaza Accord crushed the dollar 48% between 1985-1987), inflation would spike and bond markets would go crazy. In this chaos, WisdomTree thinks $5,355/oz would actually be conservative.

"As we saw in April 2025, a sharp rise in bond yields could be coupled with a sharp rise in gold price," they noted, highlighting how gold thrives when debt markets get messy.

Bottom line: Whether it's gradual gains or explosive moves, all roads seem to lead higher for gold over the next 18 months.

Peter Smith

Peter Smith

Peter Smith

Peter Smith