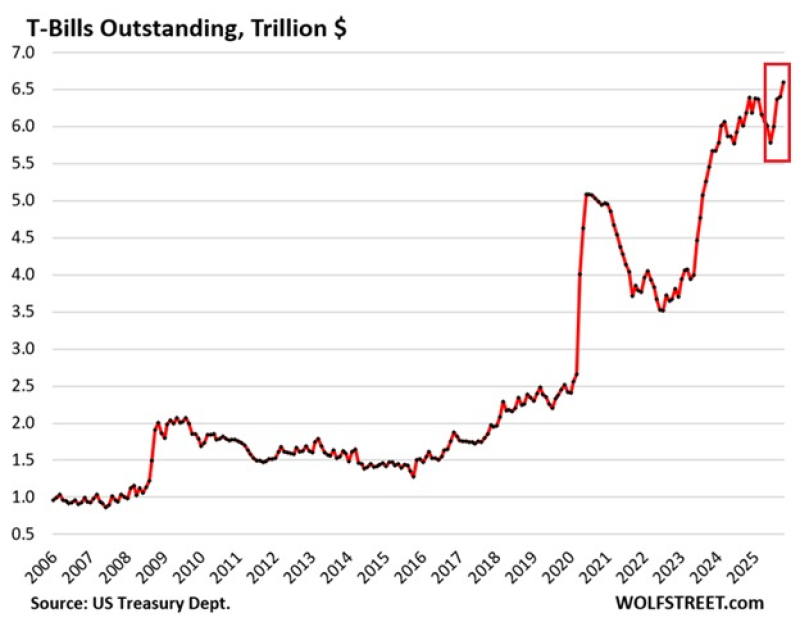

⬤ Government borrowing just hit fresh highs as short-term Treasury issuance picked up serious speed this month. Last week alone, the US Treasury pushed out $693.5 billion in securities across nine auctions over three days—one of the biggest waves since the pandemic. T-Bills outstanding now sit at $6.59 trillion, a record high that's more than doubled since 2020.

⬤ The breakdown shows heavy dependence on short-term debt. Out of that $693.5 billion, $549.1 billion came from T-Bills maturing anywhere from four to 52 weeks. Another $144.4 billion went into longer-dated notes and bonds, including $48.5 billion in 10-year notes and $28.9 billion in 30-year bonds. The chart tracking T-Bills outstanding shows a steep climb since 2022, with levels now pushing close to $6.6 trillion after rapid expansion over the past year.

⬤ T-Bills now make up roughly 22% of all marketable Treasury securities—close to the highest share since 2021. This shift points to growing short-term borrowing needs as fiscal deficits widen and refunding demands pile up. After stabilizing briefly in early 2023, T-Bill balances have shot up sharply, highlighting the acceleration in short-duration debt.

⬤ This surge in T-Bill supply underscores mounting pressure in the Treasury market. Heavy borrowing needs are colliding with higher interest rates, rising rollover risks, and ongoing worries about debt sustainability. If issuance keeps climbing at this pace, it could affect liquidity conditions, reshape yield dynamics across the curve, and play a major role in broader market sentiment heading into 2026.

Peter Smith

Peter Smith

Peter Smith

Peter Smith