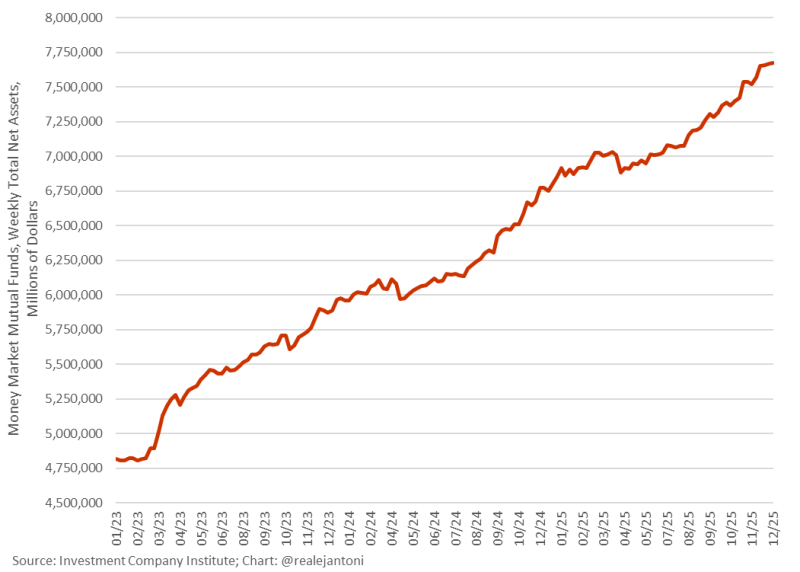

⬤ Money market balances just set another record, capping a five-week winning streak that's pushed total assets closer to $7.7 trillion. The surge reflects a massive shift from early 2023, when balances sat below $5 trillion. Now they've blown past $7 trillion and keep climbing, driven by investors piling into funds that offer attractive short-term yields without locking up their cash.

⬤ The run-up comes as Treasury bill issuance stays strong and interest rates remain elevated. Investors are sticking with money market funds that benefit from higher short-term rates, and the data shows a steady upward trend with only brief pauses over the past two years. Rather than rotating into longer-duration bonds or riskier assets, capital keeps flowing into these liquid, income-generating products.

⬤ This growing cash pile matters because it signals ongoing caution in the market. Investors are choosing yield with liquidity over risk, waiting for clearer signals on where interest rates are headed next. The continued rise in balances could shape broader capital flows and risk sentiment in the months ahead as trillions sit on the sidelines.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah