The Treasury yield curve could be heading for a major reshape as monetary policy insiders float a coordinated play: cut short-term rates while nudging banks to load up on long-duration bonds. This balance sheet migration—moving assets off the Fed's books and into commercial bank portfolios—would mark a structural shift in how liquidity flows through the economy, not just another rate cycle tweak.

Fed Balance Sheet Transfer to Banks Could Reshape Curve

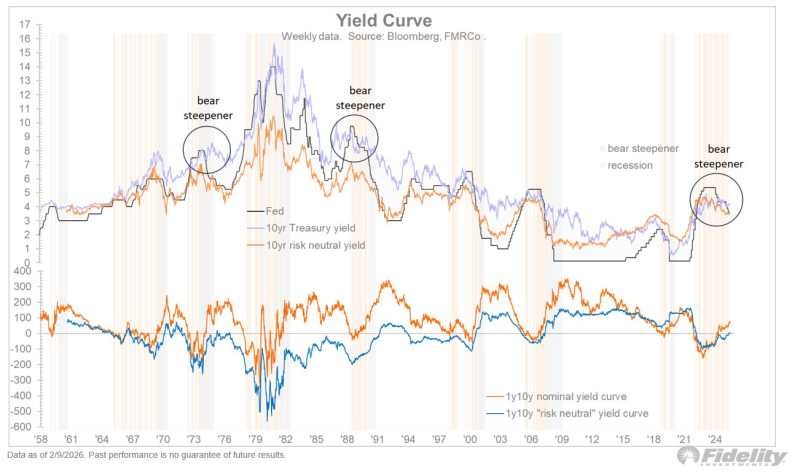

A potential monetary policy pathway could redefine the TNX Treasury yield curve through paired interest rate cuts and balance sheet moves. As Jurrien Timmer reported, one scenario involves lowering short-term rates while pushing banks to buy long-duration Treasuries, effectively shifting assets from the Federal Reserve balance sheet into private banking hands.

The chart tracks multiple historical bear steepener phases where long-term yields split from short rates during policy shifts. Under this setup, quantitative easing assets would gradually migrate from the central bank to commercial banks, shrinking direct Fed ownership of long bonds. Similar market dynamics showed up recently when the U.S. Treasury yield spread hit 69 basis points as the curve steepened toward a four-year high.

Liquidity Transmission Beyond Financial Markets

If banks pile into long-end bonds while short rates drop, the monetary multiplier could push past financial asset markets into broader economic channels.

Timmer noted, This would represent a structural change in liquidity flow rather than a routine cycle adjustment.

Historical cycles in the chart show such steepening typically happens during policy stance shifts—not at conventional easing or tightening extremes. Related yield behavior appeared in recent coverage of how the 10-year Treasury yield drives market swings as rates stay in range and balance sheet expansion effects discussed in Fed balance sheet set to keep growing matching GDP pace.

The scenario matters because Treasury curve slope dictates lending conditions, credit creation, and how monetary policy bleeds into the real economy. A sustained steepening driven by balance sheet migration would flip liquidity distribution at the source, reshaping credit flows far beyond Wall Street trading desks.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi