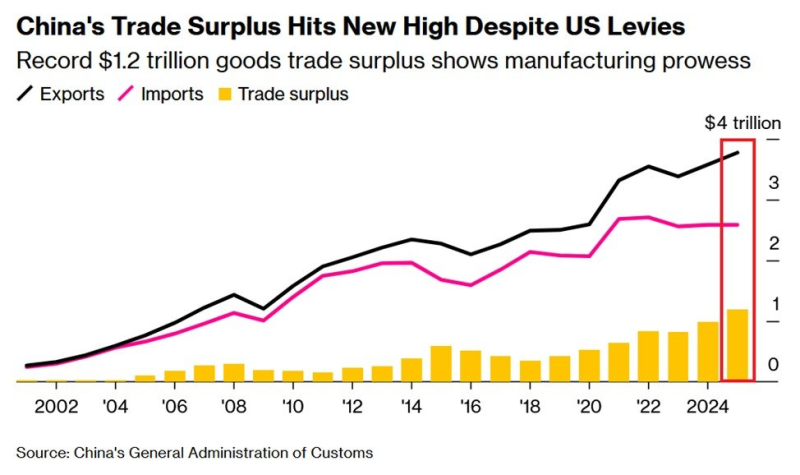

⬤ China just posted a record-breaking $1.2 trillion trade surplus for 2025, up 19.7% from the previous year. Exports climbed 5.5% to reach an all-time high of $3.8 trillion, while imports held steady at $2.6 trillion. December was particularly strong with exports jumping 6.6% year-over-year, beating every economist forecast and showing China's export machine is still firing on all cylinders.

⬤ The real story is where these exports went. Africa led the charge with a massive 25.8% surge in Chinese exports. ASEAN wasn't far behind at 13.4% growth, followed by the EU at 8.4% and Latin America at 7.4%. The U.S. was the outlier, with Chinese exports dropping 20% year-over-year. That's pushed America's share of China's exports down to just 11.1%, compared to 14.7% in 2024 – marking one of the lowest levels since the 1990s.

⬤ This shift shows China's strategy to spread its bets across more trading partners, especially as U.S.-China tensions continue. Beijing's been deliberately pivoting toward Africa, ASEAN, and other emerging markets where demand for Chinese goods is growing fast. The sharp drop in U.S. exports makes it clear China's reducing its dependence on the American market and building out alternative trade networks.

⬤ For global markets, this isn't just about China. As Beijing strengthens ties with emerging economies and relies less on the U.S., we're seeing a fundamental shift in how global trade flows. This diversification could reshape international commerce for years to come, creating a more balanced but potentially more complex trading landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah