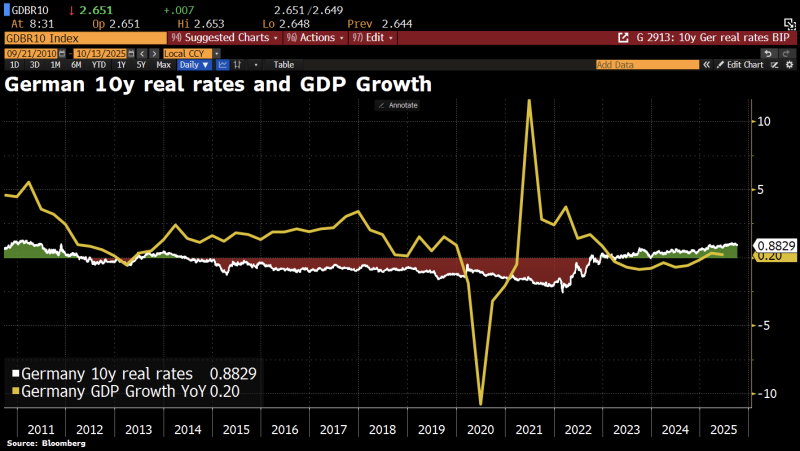

Germany is hitting a rough patch where the cost of borrowing is outrunning actual economic gains. Real yields on 10-year government bonds have now pushed past GDP growth rates, creating a troubling dynamic for the country's fiscal health. When your debt costs more than your economy is growing, you're essentially running to stand still.

Breaking Down the Numbers

Holger Zschaepitz recently highlighted this concerning trend, and looking at the Bloomberg data spanning 2010 to 2025, there's a clear story unfolding. Throughout the 2010s, real yields trended downward while GDP growth stayed marginally positive.

The pandemic hit hard in 2020, with growth plunging nearly 10% before bouncing back, though real yields stayed anchored low. Fast forward to today: real yields sit at 0.88% while GDP growth limps along at roughly 0.2% year-over-year. That's a problem. It means the returns demanded by bondholders exceed what the economy is actually producing, making every euro of government debt more expensive to service.

What's Driving This Split

A few things are colliding here. The ECB hasn't loosened its grip much despite cooling inflation, keeping interest rates elevated and pushing real yields higher. Meanwhile, Germany's manufacturing engine is sputtering under global trade friction and the costly shift toward cleaner energy, dragging down growth. That's a problem when your debt costs more than your economy produces, making every euro of government debt more expensive to service.

What It Means Going Forward

For bond investors, higher real yields might look appealing on paper, but sluggish growth clouds the longer-term picture. Policymakers face a tricky balancing act: they need to jumpstart the economy without blowing up fiscal credibility or triggering market jitters. And this isn't just Germany's headache. As Europe's economic anchor, a prolonged German slowdown could ripple across the entire eurozone, destabilizing the broader region. Whether Berlin can thread the needle between reviving growth and managing steeper financing costs will shape Germany's economic trajectory for years to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith