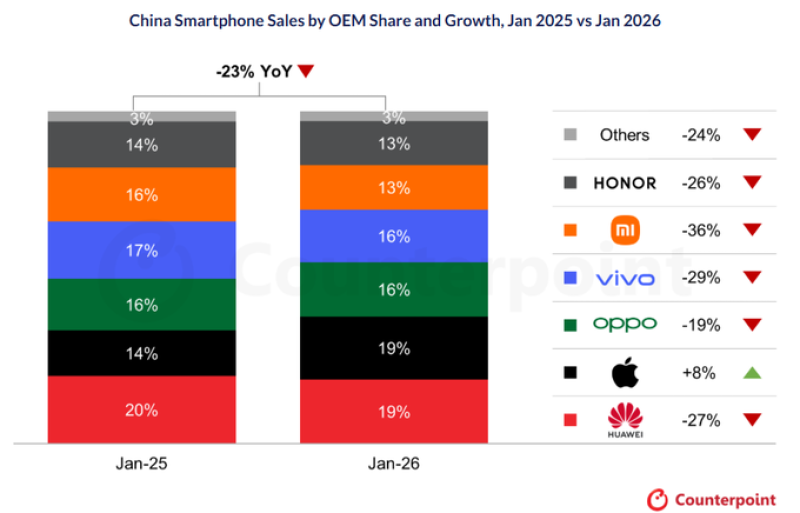

China's smartphone market hit a rough patch in January 2026, with sales tumbling 23% compared to last year. The drop stems from tougher year-over-year comparisons against subsidy-fueled demand in early 2025 and a shifted Lunar New Year calendar. Yet one brand bucked the trend entirely—Apple carved out gains while every major Android rival watched volumes shrink. Counterpoint data, flagged by Walter Bloomberg, reveals how subsidy programs and product timing rewrote the competitive map in the world's largest smartphone market.

Apple Gains Ground While Market Contracts

Huawei held the top spot with 19% share in January 2026, edging down from 20% a year earlier, even as Huawei sales dropped 27% year over year. Counterpoint credited aggressive trade-in deals and subsidy support for keeping Huawei ahead during the market-wide slump. Other Android heavyweights posted steeper declines: Xiaomi fell 36%, Vivo slid 29%, HONOR dropped 26%, and Oppo declined 19%, highlighting broad weakness across the segment.

iPhone revenue jumped 23% year over year, and Apple stood alone among major brands with sales up roughly 8% year over year. Its share surged to 19% from 14% in January 2025—the highest January figure in five years. Counterpoint noted the iPhone 17 gained traction and qualified for government subsidies, driving relative strength even as total market volumes tumbled.

As Walter Bloomberg observed, Subsidy eligibility and product cycle timing can materially shift monthly share outcomes inside a declining market.

What January's Numbers Mean for the Year Ahead

The divergence between Apple and Android rivals underscores how subsidy rules shape demand. While Apple's smartphones are not the most popular globally, the brand's momentum in China—historically a challenging market—signals strong product-market fit and favorable policy alignment. Counterpoint expects conditions to improve in February as Lunar New Year buying lifts seasonal demand.

January's snapshot matters because China remains a critical global smartphone battleground. Sharp contractions paired with rapid share shifts influence near-term expectations for device makers' competitive positioning, momentum, and how subsidy programs steer consumer behavior. The question now is whether Apple can sustain its edge once seasonal support fades and rivals recalibrate their promotional strategies.

Usman Salis

Usman Salis

Usman Salis

Usman Salis