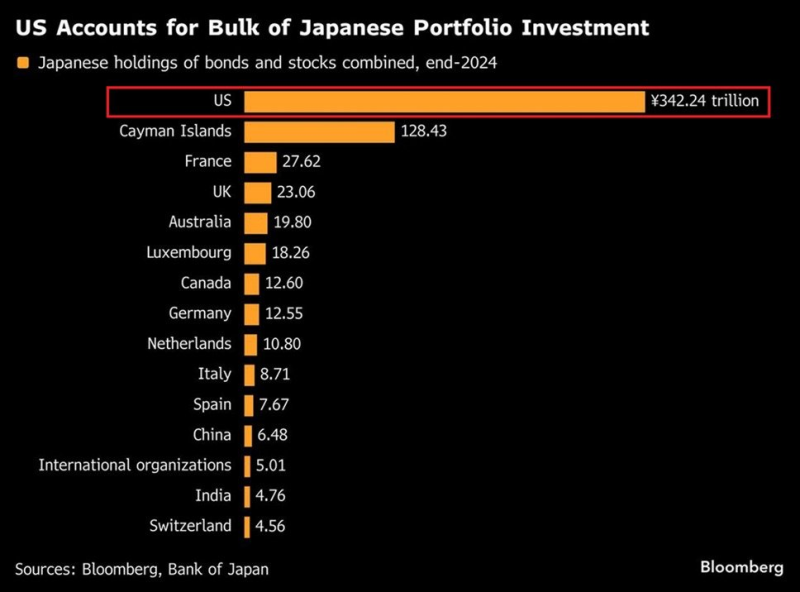

⬤ Japanese investors remain heavily exposed to US financial markets, with America accounting for the largest share of Japan's overseas portfolio investment. Japanese holdings of US bonds and stocks totaled $2.22 trillion at the end of 2024, based on Bank of Japan data. The US clearly dominates Japan's foreign asset allocation, standing well above all other destinations.

⬤ The numbers tell the story. After the United States, the next largest recipients of Japanese portfolio investment are the Cayman Islands at roughly $834 billion, France at approximately $179 billion, and the UK at around $150 billion. Even combined, these three markets attract only about half the capital Japan has allocated to US assets.

⬤ Total foreign assets held by Japanese investors rose to $4.95 trillion in Q3 2025, bringing overall exposure close to record highs. Within this total, $2.54 trillion went into equities and investment fund shares, while $2.41 trillion landed in debt securities. The US serves as a central destination across both equity and fixed-income markets.

⬤ The scale of Japanese exposure to US assets matters because Japanese investors represent one of the largest sources of cross-border capital flows worldwide. A portfolio this heavily weighted toward the United States means any shift in allocation preferences could noticeably affect liquidity, asset prices, and market dynamics. The data shows how deeply interconnected Japanese capital has become with US financial markets, making international investment trends a key factor shaping global financial conditions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis