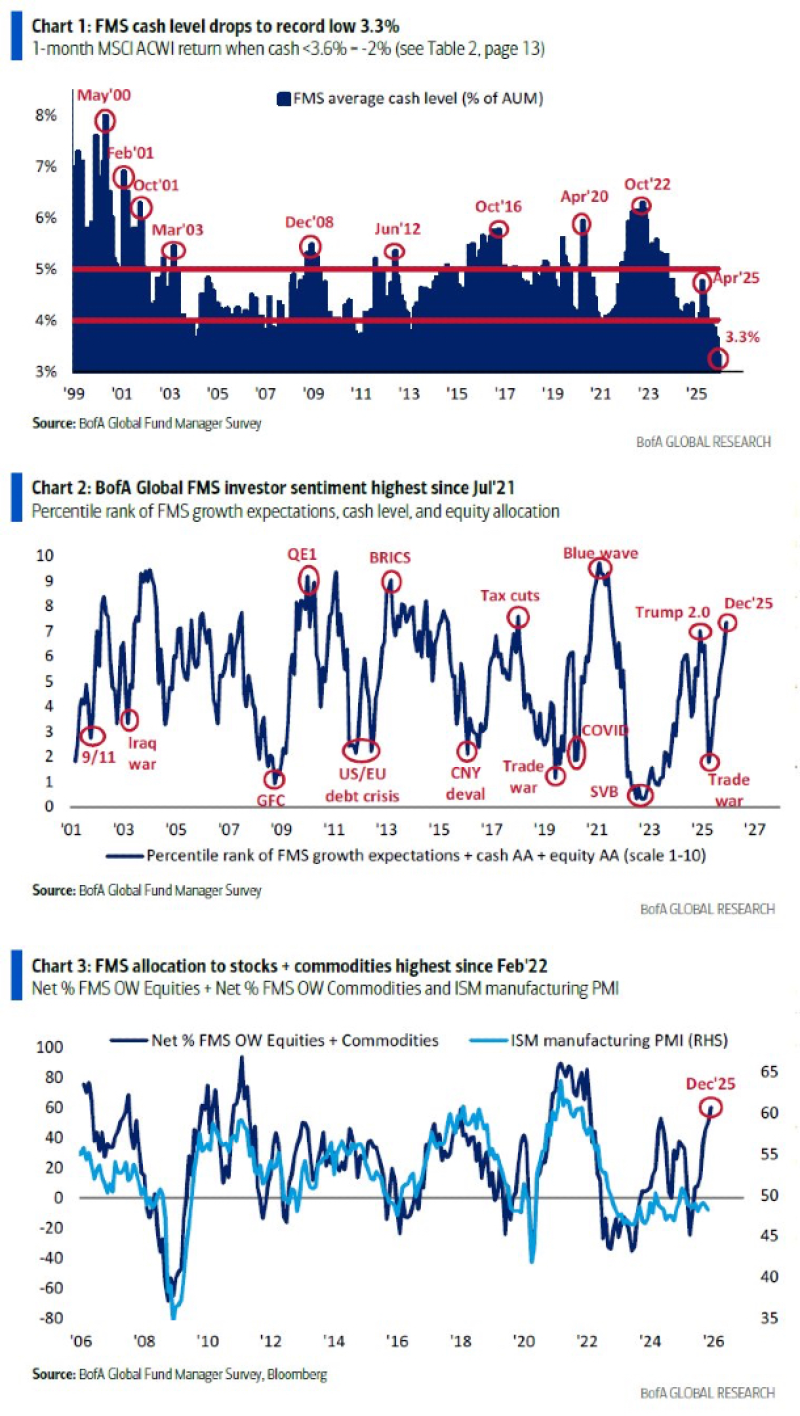

⬤ Investors are now betting almost everything on risk. Cash reserves have fallen to the lowest level ever measured, while demand for stocks and raw materials has risen to a peak last reached in mid-2021. Fresh figures show that fund managers hold the smallest cash buffer on record and are pouring money into shares plus commodities, a sign of unusual optimism as 2025 draws to a close.

⬤ The Bank of America Global Fund Manager Survey reports that cash now accounts for only 3.3 % of the assets they oversee, the slimmest share since the survey began. This reading sits far below any level observed in earlier cycles, which underlines how fully invested portfolios have become. The slide that started in 2024 and carried through 2025 points to firm trust in further market gains and to scant interest in defensive positioning.

⬤ Sentiment has climbed to its strongest mark since July 2021, judged by a blend of growth forecasts, cash weightings and equity exposure. One strategist remarked that “with almost no cash left on the sidelines, markets could overreact to small changes in data or in growth views.” The sentiment gauge has rebounded from prior troughs but also now sits near the top of its historic band. Allocations to shares and raw materials have reached their heaviest weight since February 2022 underlining the tilt toward growth sensitive assets as economic momentum firms.

⬤ The mix of record low cash, elevated sentiment and large risk asset holdings is significant because it reveals how one sided positioning has become. With little spare cash left to deploy, prices may lurch on any surprise in the data or in the growth narrative. Although the present stance signals broad confidence across global funds, it also implies that volatility could surge if mood or economic conditions begin to reverse.

Usman Salis

Usman Salis

Usman Salis

Usman Salis