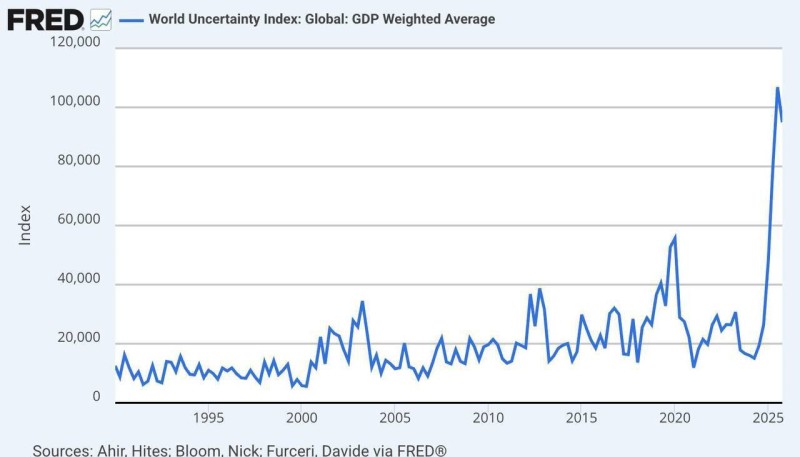

⬤ The World Uncertainty Index has smashed through its previous records, climbing higher than the crisis peaks from both 2008 and 2020, according to Kyledoops. The FRED chart tracking the "World Uncertainty Index: Global: GDP Weighted Average" shows a dramatic vertical jump in recent readings—visually dwarfing every other spike in the decades-long dataset.

⬤ While the index has historically jumped during major economic disruptions, this latest surge stands out as the biggest yet. The current backdrop is packed with risk factors: escalating Middle East tensions, chatter about a potential U.S. government shutdown, and fresh tariff-related developments. These are exactly the kinds of headlines that tend to emerge when uncertainty gauges go haywire—a pattern we've seen reflected in how the stock market fear index nears extreme levels.

⬤ The recent explosion in the World Uncertainty Index comes after years of relatively calm conditions broken only by brief, temporary spikes. Now we're seeing an abrupt acceleration that screams political and macroeconomic stress rather than normal economic cycles. Similar reactions to policy chaos have shown up in recent stories about gold hitting record highs amid shutdown fears.

⬤ Why does a record-high uncertainty reading matter? Because uncertainty hits expectations across financial markets and economic activity all at once. When readings spike this hard, markets become hypersensitive to geopolitical headlines and trade policy moves—especially around tariffs, as we've seen with gold hitting record highs as US-China trade tensions escalate. The sheer size of this jump tells us we're entering a period where macro conditions can shift fast and affect markets worldwide.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah