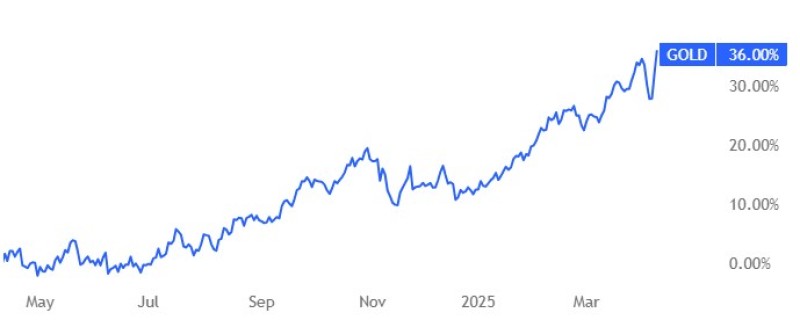

Gold reached a historic peak of $3,171 per ounce on Thursday amid increasing trade tensions between the United States and China, with the precious metal continuing to serve as a safe haven during economic uncertainty.

Gold (XAU) Surges to All-Time High Amid Dollar Weakness

Gold prices climbed to trade around $3,167 per ounce on Thursday, after momentarily touching a record high of $3,171. This remarkable surge was primarily driven by a combination of a weakening dollar and heightening trade tensions between the United States and China, which significantly boosted investor demand for the safe-haven metal.

The dollar index experienced a notable decline of more than 1%, making gold substantially more affordable for investors using other currencies. This currency dynamic played a crucial role in pushing gold to unprecedented price levels as international buyers found greater purchasing power in the gold market.

Gold (XAU) Rallies Following Trump's Tariff Decision

The dramatic price spike in gold followed President Trump's significant policy decision to increase tariffs on Chinese goods to 125%, a substantial increase from the previous 104%. This aggressive trade stance was slightly tempered by his simultaneous decision to temporarily ease duties on goods from other countries, creating a targeted approach to trade pressure.

These escalating trade tensions between the world's two largest economies have rekindled concerns about global economic stability and growth prospects. In such uncertain economic environments, investors traditionally turn to gold as a reliable store of value, which has been demonstrated once again in this latest price rally.

Gold (XAU) Benefits from Inflation Concerns and Rate Cut Expectations

While U.S. consumer prices unexpectedly fell in March, providing temporary relief to inflation watchers, broader inflation concerns remain elevated due to the potential impact of the new tariff hikes. Higher tariffs typically lead to increased prices for imported goods, which can contribute to inflationary pressures throughout the economy.

In response to these economic developments, market participants have adjusted their expectations regarding the Federal Reserve's monetary policy. Traders are now increasingly betting that the Federal Reserve will resume cutting interest rates as soon as June, with expectations of a full percentage point reduction by the end of the year.

Lower interest rates generally benefit non-yielding assets like gold, as they reduce the opportunity cost of holding the precious metal instead of interest-bearing securities. This expectation of a more accommodative monetary policy has further strengthened gold's appeal among investors.

Gold (XAU) Reinforces Role as Economic Uncertainty Hedge

Gold continues to benefit from its traditional and historical role as a hedge against both economic and geopolitical uncertainty. The metal's performance during this period of trade tension reinforces its status as a reliable safe-haven asset during times of market volatility and economic instability.

The current gold rally also reflects broader concerns about the global economic outlook, with investors seeking protection against potential market disruptions that could result from the ongoing trade disputes between major economies. Gold's limited supply and universal acceptance make it particularly valuable during periods when confidence in conventional financial assets and currencies may be wavering.

As trade negotiations continue and economic data evolves, gold prices will likely remain sensitive to developments in international relations, monetary policy decisions, and broader economic indicators. For now, the precious metal stands at historic highs, reflecting significant investor concern about near-term economic and political stability.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah