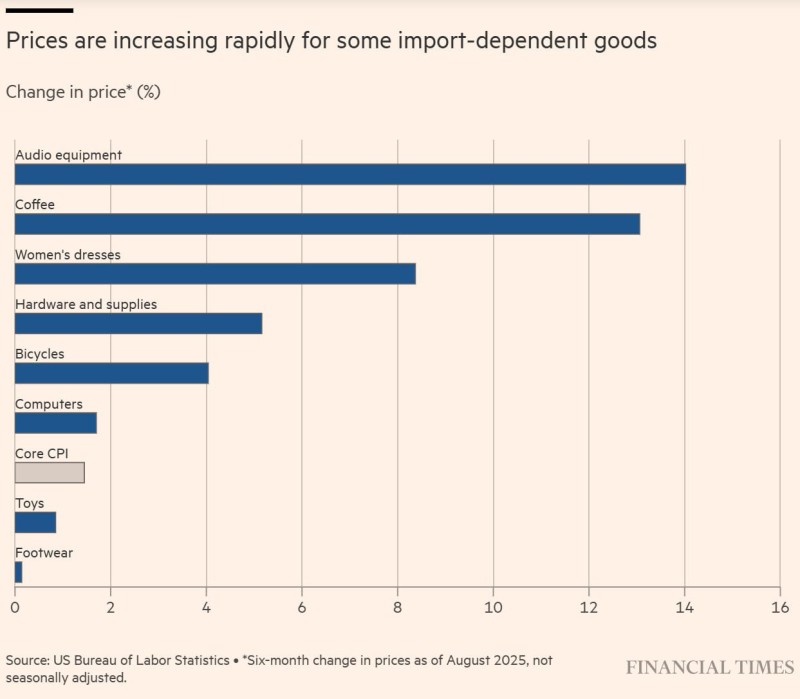

After two years of relatively stable commodity prices, inflation is making a comeback in specific segments of the U.S. consumer market. Bureau of Labor Statistics data shows that products relying heavily on imports are experiencing sharp price jumps, even while core inflation stays moderate. This pattern reveals how trade policies and global supply chain issues are increasingly affecting American household budgets.

Import-Driven Price Increases

The latest six-month figures highlighted by trader Dzis Maksym paint a clear picture.

Import-dependent products are leading the price surge, with some categories seeing double-digit increases.

The data reveals:

- Audio equipment saw the steepest climb at nearly 15%

- Coffee prices jumped close to 13% due to supply chain challenges and tariff impacts

- Women's dresses increased around 9%

- Hardware supplies and bicycles rose between 4-5%

- Core CPI remained just under 3%

This data shows that inflation isn't widespread but concentrated in specific import-dependent categories. The gap between overall inflation and import-sensitive goods means that while headline numbers look reasonable, everyday shoppers are feeling the pinch in particular product areas.

Why Prices Are Rising

The price acceleration stems from several interconnected factors. Tariff policies, both extended and newly implemented, have increased costs for importers, especially in electronics and clothing. Companies are still reorganizing their sourcing networks, often moving away from cheaper suppliers, which adds to costs. Businesses are now more willing to raise retail prices to protect their profit margins. Additionally, certain commodities like coffee face pressure from climate disruptions and global supply issues that have nothing to do with tariffs.

Market and Policy Implications

These trends carry real consequences. Higher prices for everyday items could squeeze household budgets and reduce spending on non-essentials. For the Federal Reserve, import-driven inflation complicates future monetary policy decisions. Retailers and businesses dependent on imports may see thinner margins unless they can successfully pass costs along to customers without losing sales.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah