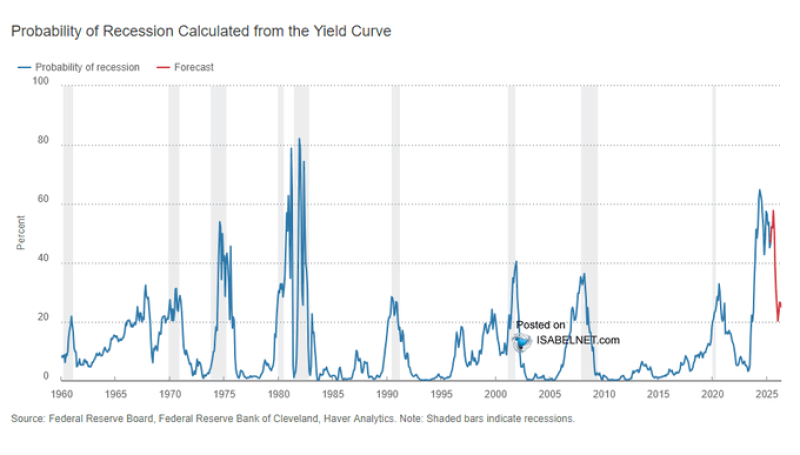

The chances of America sliding into a recession are looking way better than they did just a few months ago. The latest data shows recession risk has dropped to 25% in May, which is a huge relief compared to the scary 60%+ odds we were seeing earlier this year.

US Economy Shows Signs of Life as Recession Risk Plummets

So here's the deal - the Federal Reserve Bank of Cleveland has this nifty model that tracks recession probability, and it's basically telling us to chill out a bit. The recession risk for the next 12 months has dropped to 25.0% as of May 2025, which is honestly a breath of fresh air after all the doom and gloom we've been hearing.

Earlier this year, things were looking pretty rough with recession odds spiking above 60%. That had everyone freaking out about whether we were heading for another economic crash. But now? The numbers are telling a completely different story.

The whole thing is based on the yield curve - you know, that thing where they look at the difference between long-term and short-term Treasury yields. It's been scary accurate at predicting recessions in the past, so when it starts looking better, people actually pay attention.

Historical Data Shows This Model Knows Its Stuff

Let's be real - this isn't some random prediction model that gets it wrong half the time. Looking at the chart data from 1960 to 2025, this thing has been spot-on about calling recessions. It nailed the economic crashes in 1980, 1990, 2001, 2008, and 2020, with probabilities shooting up to 60-80% right before each one hit.

What's really encouraging is that the current trend line (the red one on the chart) is heading downward instead of spiking up like it did before all those previous recessions. The shaded gray areas on the chart show when actual recessions happened, and right now we're nowhere near those danger zones.

It's like having a really good weather forecast that's been right about every major storm for the past 65 years - when it says the storm clouds are clearing, you tend to believe it.

What This Means for Traders and Your Portfolio

Okay, so what does this 25.0% recession probability in May actually mean for people trying to make money in the markets? Well, it's pretty much a green light for more aggressive investing strategies.

This kind of news usually gets traders excited about "risk-on" plays. We're talking tech stocks, consumer spending companies, banks - basically all the stuff that gets hammered when people think a recession is coming. With those fears backing off, money tends to flow back into these sectors.

The Fed's probably breathing a little easier too. When recession risk was through the roof, everyone was expecting them to slash interest rates like crazy. Now they've got more room to be patient and not panic with their policy decisions.

For regular investors, this could mean we see some renewed energy in the stock market and corporate bonds. But hey, don't go crazy - 25% is still one in four odds, so it's not like we're completely out of the woods yet. Smart money is still keeping some powder dry just in case the economic winds shift again.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah