Markets are bracing for a pivotal inflation release today as the U.S. inflation report for September, scheduled at 14:30 local time, captures renewed price pressures from energy costs and tariffs amid signs of labor market weakness.

Truflation vs. Market Consensus

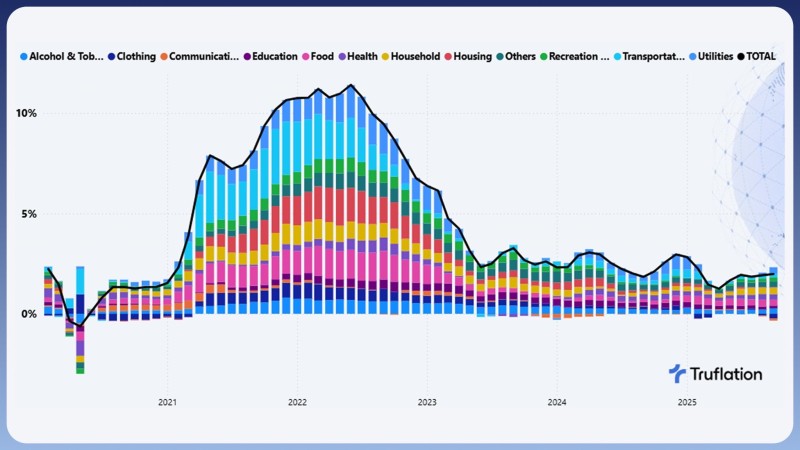

Most financial institutions forecast a 3.1% year-over-year increase in headline inflation, the highest since May 2024. However, according to trader RobynHD's analysis, Truflation projects a slightly lower 3.0% reading, tracking real-time price data that suggests a more modest rise.

This divergence highlights uncertainty around energy costs and supply disruptions. The Truflation chart shows inflation peaking above 10% in 2022 before falling steadily, though the decline has slowed since mid-2024, stabilizing between 2.5% and 4%. A mild uptick in energy and transportation echoes recent oil volatility, while housing, food, and health remain steady, indicating persistent price rigidity across essential goods.

Economic Crosswinds: Growth vs. Employment

Despite slowing inflation, GDP expanded 3.8% last quarter. Yet unemployment sits at 4.3%, and hiring sentiment has hit its lowest since 2009. This creates a Fed dilemma: ease too soon and inflation rebounds, tighten further and growth suffers.

Fed Still Caught Between Growth and Inflation

Whether CPI comes in at 3.1% or 3.0%, the message is clear: inflation is cooling but not defeated. The Fed will remain cautious, balancing growth against price pressures. For investors, this release could determine the next Fed move and short-term direction for stocks, bonds, and crypto markets.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi