In a development that's got Wall Street buzzing, U.S. inflation has dropped to its lowest level in months, creating a perfect storm for potential market gains. The latest Truflation data shows prices cooling faster than many expected, and investors are already positioning themselves for what could be a significant shift in Federal Reserve policy.

Inflation Slips to 1.97%, Strengthening Market Sentiment

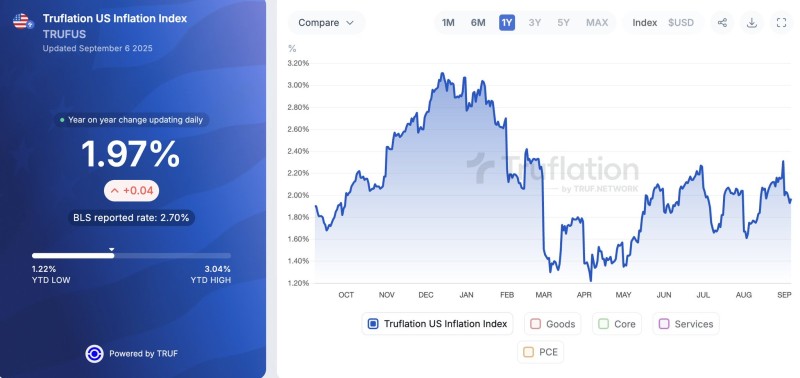

The Truflation Index just delivered some welcome news: U.S. inflation has fallen to 1.97%, well below the official Bureau of Labor Statistics rate of 2.70%. This represents one of the lowest readings we've seen in 2025, suggesting that price pressures are finally easing across the economy.

For investors who've been waiting for signs that the Fed might ease up on its hawkish stance, this data couldn't have come at a better time. Crypto analyst @TheDustyBC pointed out in his recent market update that inflation dropping below the 2% threshold isn't just good news—it's potentially game-changing for both traditional markets and digital assets like Bitcoin and altcoins.

Fed Rate Cut Odds Rise as Inflation Eases

The gap between Truflation's real-time data and the BLS figure shows just how quickly things are changing. Market participants are increasingly betting that the Fed will need to pivot sooner rather than later, with rate cuts likely on the horizon.

History tells us that when inflation falls and monetary policy loosens, risk assets tend to thrive. Lower borrowing costs mean more liquidity flowing into markets, making everything from stocks to gold to Bitcoin and Ethereum look more attractive to investors seeking returns.

What It Means for Investors Going Forward

Looking at the bigger picture, inflation has been all over the map this year—hitting a low of 1.22% and a high of 3.04%. Now that we're seeing it cool down again, confidence is returning to both traditional and crypto markets.

If inflation stays below 2%, analysts are expecting a broad market rally through the end of 2025. Stocks could continue their upward march, while cryptocurrencies like Bitcoin, Ethereum, and XRP might see fresh money flowing in as investors bet on a more dovish Fed approach.

Usman Salis

Usman Salis

Usman Salis

Usman Salis