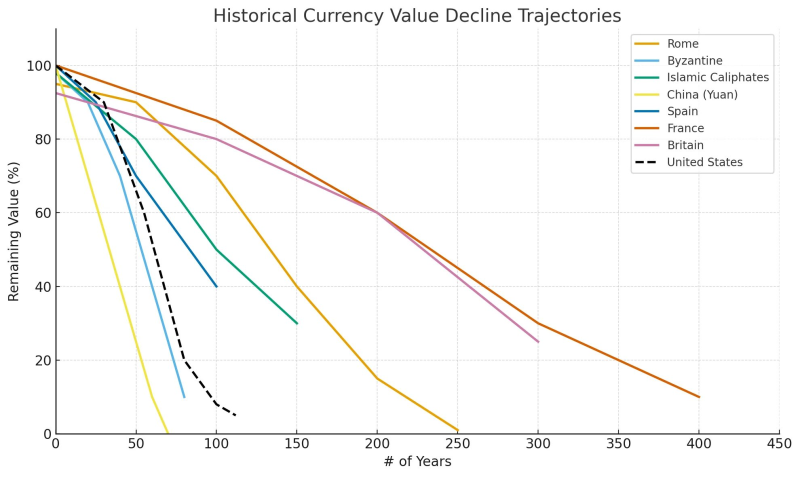

● Twitter analyst Carl ₿ MENGER recently shared a warning: history is repeating itself with the U.S. dollar. His chart, "Historical Currency Value Decline Trajectories," compares major empires from Rome and Byzantium to Britain and America, showing they all followed the same downward spiral—expansion, reckless spending, and monetary collapse.

● The pattern is always the same: military overstretch, runaway government spending, currency debasement, rising inflation, and collapsing public trust.

Every empire dies following the same pattern. Each time, rulers thought this time is different. They were wrong, every single time. Prepare accordingly. Carl ₿ MENGER wrote

● The chart makes a troubling point—the U.S. dollar's path (shown as a black dashed line) looks eerily similar to past reserve currencies before they fell. Historically, empire currencies lost over 80% of their value within centuries, often ending in hyperinflation or total collapse.

● The warning signs are there: America's national debt has topped $35 trillion, fiscal policy keeps expanding, and deficits keep growing. Add rising debt costs and geopolitical overreach, and it's easy to see why some think the U.S. may be entering the final stage of its monetary dominance—just like Britain in the 1900s or Rome centuries earlier.

● Currency debasement isn't just about money—it's a sign of deeper decay. Once trust is gone, collapse comes fast. History proves this: the Roman denarius, the French livre—once confidence breaks, it rarely comes back.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova