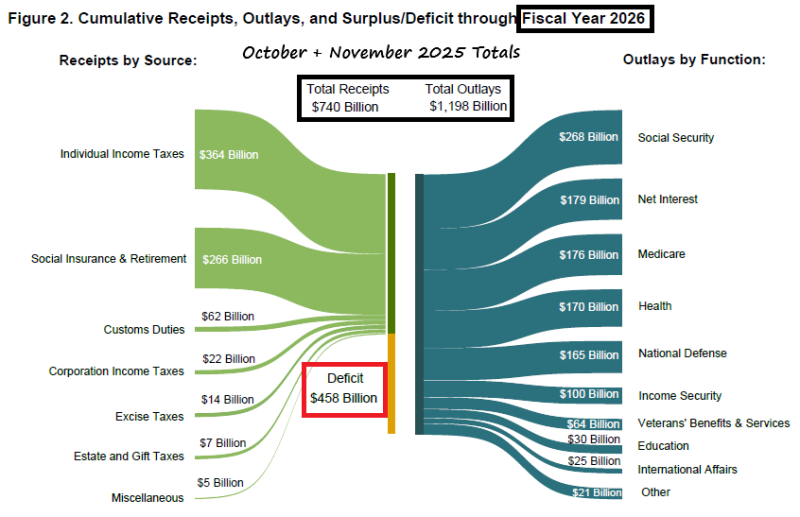

⬤ The United States began Fiscal Year 2026 with a large budget gap - it received $740 billion in revenue but spent $1.198 trillion. The two month deficit of $458 billion reveals that government expenditures now far exceed income. Social Security, Medicare and defense push costs upward, while tax receipts fail to keep pace.

⬤ Individual income taxes supplied $364 billion, the largest share. Social insurance plus retirement contributions added $266 billion. Customs duties yielded $62 billion. Corporate taxes provided $22 billion. Excise and estate taxes supplied smaller amounts. Even so those inflows did not cover outlays - Social Security alone required $268 billion, a sum larger than one third of total revenue.

⬤ Interest on the national debt cost $179 billion for the period, the second highest outlay after Social Security. Medicare required $176 billion. Health programs used $170 billion. National defense needed $165 billion. The chart shows how early year spending in multiple areas rapidly overtakes revenue.

⬤ Income security programs received $100 billion. Veterans’ benefits, education but also international affairs took further funds. The persistent gap between revenue and expenditure raises doubts about long term budget stability. Interest charges rise as well as spending pressures show no let up. This early deficit establishes a troubling trend for the remainder of the fiscal year and forces policymakers to confront tax policy or spending choices directly.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah