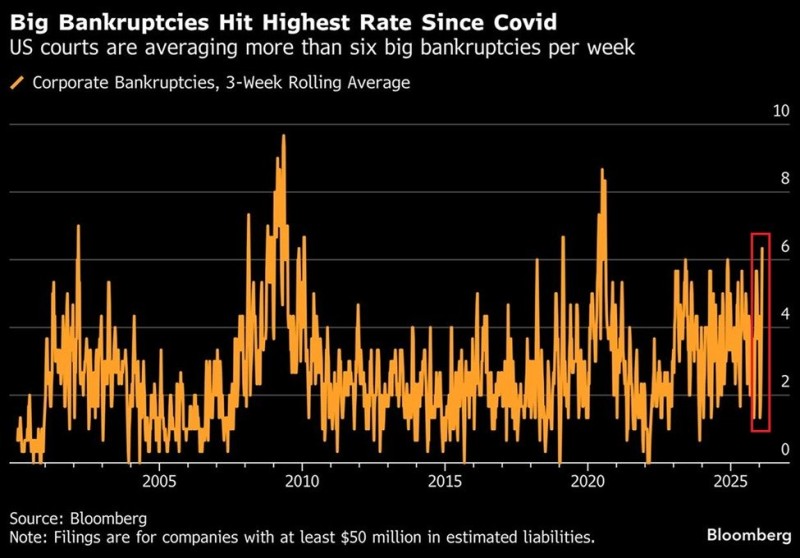

The number of large corporate bankruptcies in America just jumped to levels we haven't seen since the chaos of 2020. With nine major companies filing for bankruptcy protection in a single week, financial alarm bells are ringing across markets. The three-week rolling average now sits at six cases—a threshold that historically shows up only during serious economic trouble.

A concerning spike in U.S. corporate bankruptcies has caught the attention of market watchers after recent data revealed a sharp increase in filings. Nine large companies filed for bankruptcy last week, pushing the three-week average to six cases—the highest level since the 2020 pandemic shock. These figures track companies carrying at least $50 million in liabilities, confirming a real shift in corporate financial health.

Looking back at history makes this trend even more striking. We've only seen this kind of bankruptcy acceleration during three previous moments: the post-2001 recession, the 2008 financial crisis, and the COVID-19 economic shutdown. Over just the past three weeks, at least 18 large companies have entered bankruptcy protection. The worst point this century came in 2009, when the three-week average hit nine filings, but the current pace suggests pressure is building fast across companies carrying heavy debt loads.

As one market analyst noted, "The rate marks a clear upward move from typical baseline levels and indicates tightening financial conditions."

The data clearly shows large bankruptcies climbing above six per week on average. That's a significant jump from normal levels and points to tougher financial conditions. Higher borrowing costs, slower economic growth, and weakening balance sheets typically drive this type of surge. Previous corporate distress cycles like this have regularly lined up with broader economic slowdowns and tighter market liquidity. The pattern also connects with corporate bankruptcy surge trends, reinforcing signs of mounting financial stress across businesses.

Why This Bankruptcy Wave Matters for Markets

This development matters because corporate defaults usually show up before wider economic adjustments kick in. When bankruptcy filings accelerate, it reflects tightening credit conditions and companies running low on cash flow cushions. As more filings come through, markets typically start rethinking risk expectations, credit spreads widen, and sector leadership shifts—signaling a change in overall economic momentum rather than just isolated trouble spots.

The current bankruptcy rate serves as an early warning system that financial conditions are getting harder for companies to navigate, potentially foreshadowing broader challenges ahead for the economy.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah