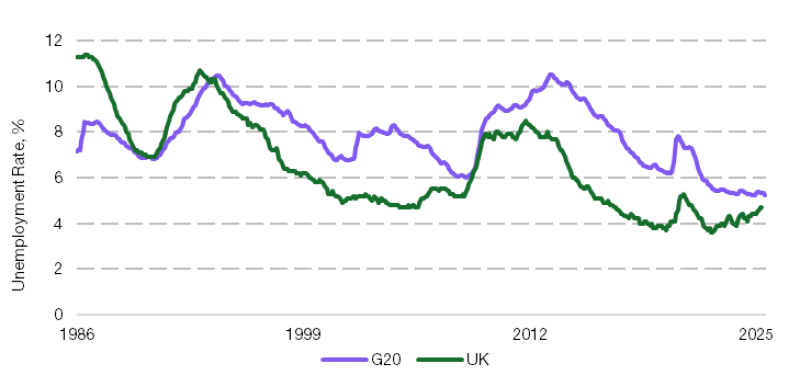

Britain's job market just hit a concerning milestone. While unemployment across the G20 has been steadily improving, the UK is heading in the opposite direction. The numbers tell a clear story: vacancies are dropping, unemployment is climbing past 4%, and even the reliable workforce job estimates are starting to flatten out.

The Growing Divide

As Simon French pointed out, the UK is becoming the odd one out in a group of economies that should be moving together.

The contrast is stark. G20 unemployment has been falling since 2021 and now sits comfortably around 5-6%. Meanwhile, the UK is watching its jobless rate creep higher from what seemed like a solid foundation. It's not just one indicator either - this is happening across multiple measures:

- Falling job postings: Companies are pulling back on hiring

- Rising unemployment: The rate is climbing after years of stability

- Stalling employment growth: Even workforce estimates are losing momentum

What's Really Going On

Two policy changes keep coming up in recruiter surveys. National Insurance contributions are making it more expensive to hire people, which naturally makes employers think twice. The National Living Wage increases are helping low-income workers but putting serious pressure on small and medium businesses trying to balance their books. Add persistent inflation to the mix, and you've got a perfect storm that's hitting the UK harder than its peers.

This isn't just about numbers on a spreadsheet. A weakening job market hits consumer spending, which hits growth, which creates a downward spiral. The Bank of England is stuck between a rock and a hard place - cut rates too fast and inflation might come roaring back, keep them high and job creation suffers even more.

The UK is becoming an outlier when it should be part of the pack. Unless policymakers find a way to address the structural issues behind these trends, the gap with other major economies will only get wider. That's a dangerous place to be in an interconnected global economy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis