Oil sits at the heart of today's inflation conversation, but recent price action tells a story that contradicts what many policymakers expected. While the Federal Reserve maintains its cautious stance, crude markets are flashing disinflationary warnings - possibly even deflationary ones. WTI has dropped over 6% recently, and the technical picture suggests this might just be the beginning of a much steeper correction.

Technical Breakdown Shows Bearish Structure

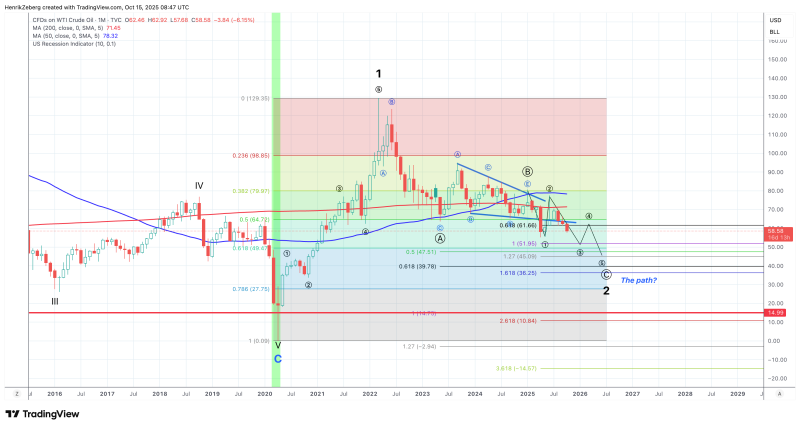

WTI is currently trading at $58.58, positioned well beneath both the 50-month moving average at $78.32 and the 200-month at $71.45. This placement alone signals significant weakness. Trader Henrik Zeberg's Elliott Wave analysis suggests we're watching a "Wave 2" correction that could drive prices down to the $36–$40 zone.

Key Fibonacci retracement levels sit at $64.72 and $49.47, with downside extensions pointing toward $39.78 and $36.25. In an extreme scenario, technical projections even hint at a possible $15 target, though that remains a tail risk.

The Inflation Puzzle

Here's where things get interesting. Zeberg draws a distinction between stock and flow—the price level versus the rate of change. Think of it like a bathtub: the water level might still be high, but if you've turned down the tap, eventually that tub will drain.

Oil prices remain elevated compared to 2020 lows, but the inflation rate itself is already slowing. Falling energy costs will likely pull headline inflation lower in coming months, yet the Fed's tight policy stance suggests they're still fighting yesterday's battle. By focusing too much on where prices are rather than where they're headed, policymakers risk overtightening just as the economy needs support.

What's Next for Oil Prices

Two paths emerge from here. In a bullish scenario, oil finds support above $60 and rebounds toward $70–$80, likely driven by supply disruptions or geopolitical flare-ups. The bearish case sees continuation toward $50 first, then a deeper slide into the $36–$40 range matching those Fibonacci projections and wave patterns. Given current momentum and macro conditions, the bearish path appears more probable.

Peter Smith

Peter Smith

Peter Smith

Peter Smith