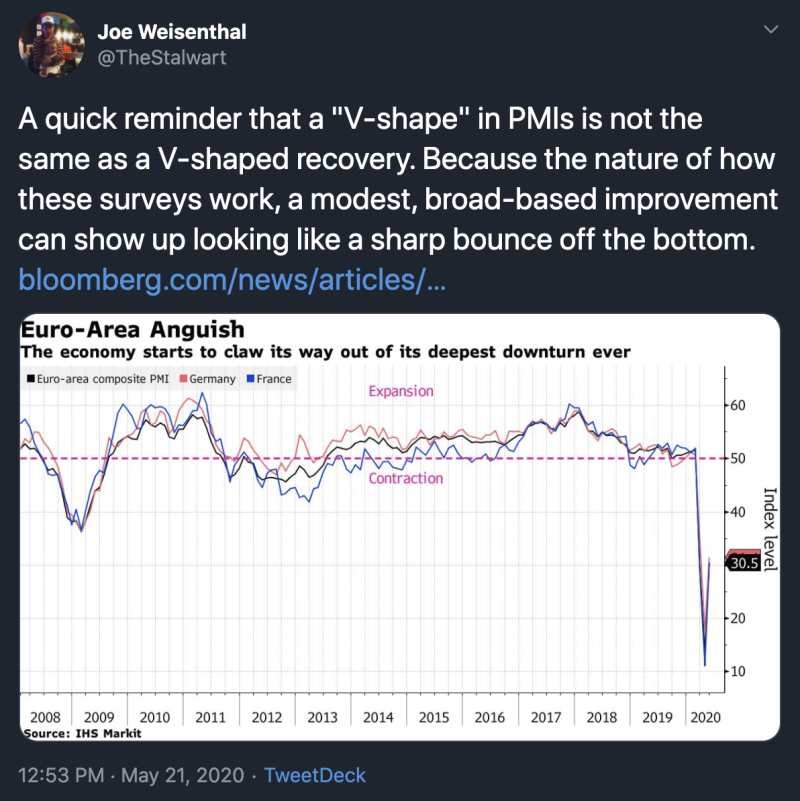

Joe Weisenthal, the co-host of ‘What’d You Miss’ on Bloomberg TV, recently tweeted a warning about the sharp recovery in the European Purchasing Managers’ Index (PMI). The rebound should be treated carefully and without excessive optimism.

Why does PMI matter?

The manufacturing and services sectors are the pillars of every country’s economy, they contribute a great deal to the Gross Domestic Product (GDP). PMI reflects the health of these sectors and therefore indicates how the overall economy does.

PMI is constructed from data gathered from surveys of purchasing managers of various companies. Surveys are collected monthly and PMIs reflect month-over-month changes.

If PMI is 50, the sectors are stable. If the index is above 50, it indicates that the demand is growing and the sectors are doing well. The value below 50 points to contraction.

The current value of the European PMI in May, 2020 is 39.5, a sharp increase from 33 in April. Companies are starting to get back to business as the restrictions are easing. While this sign is definitely positive, the optimism should be cautious, says Joe Weisenthal.

V-shape Recoveries

On his personal twitter page, Joe warned against treating the spike in European PMI as the economy becoming significantly stronger. He referred to the underlying mechanisms of gathering data for PMIs, which amplify even small improvements.

In short, this means that the European economy still struggles, while showing some positive signs. While many are hoping for things to recover quickly, the recession may end up being not V-shaped, but U-shaped, W-shaped, or L-shaped. In such a case, it would take more time to return to economic growth.

Businesses are opening up to an aftermath of the several-month crisis, which will require them rethink their old practices and build new from the ground up. Hence, every step towards recovery should be percepted with caution.

Usman Salis

Usman Salis

Usman Salis

Usman Salis