Italy's inflation remained subdued in September, showing no signs of accelerating price pressures in the eurozone's third-largest economy. The Consumer Price Index climbed 1.6% year-on-year, falling just short of the 1.7% forecast while matching August's reading. These numbers point to ongoing disinflationary trends despite earlier jumps in energy and food costs.

CPI Data Breakdown

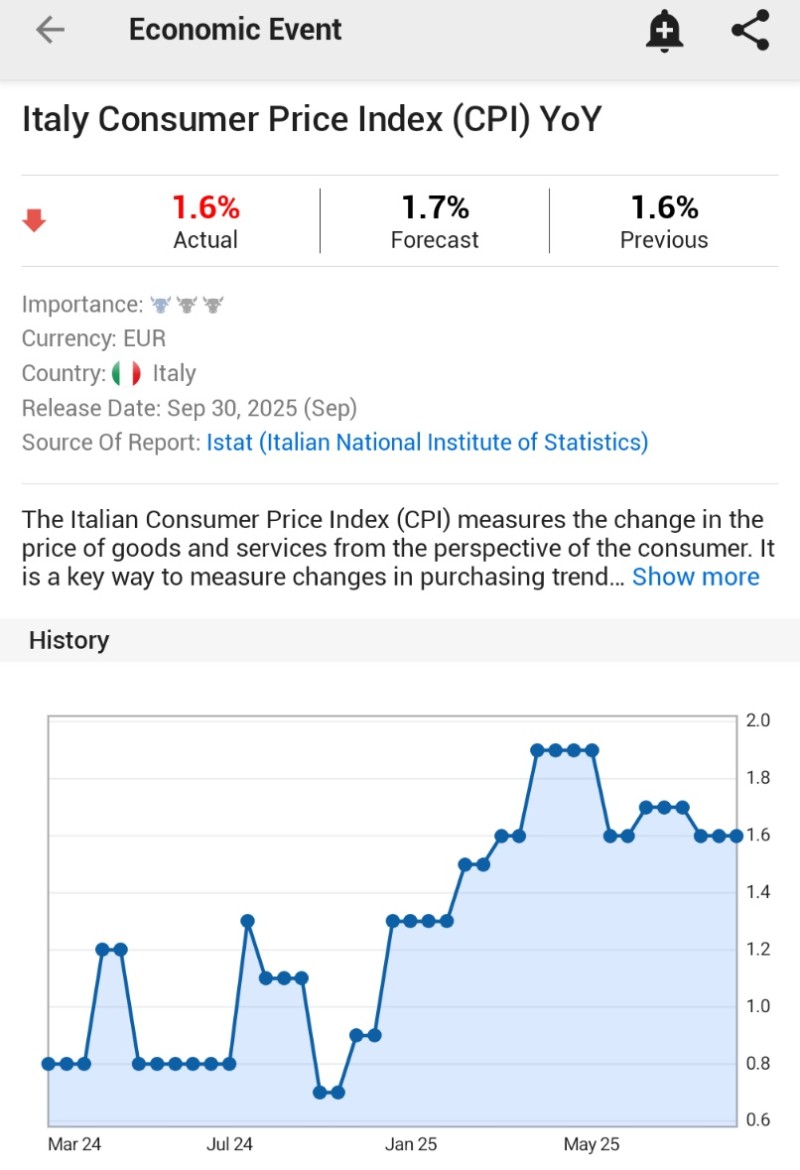

The actual September 2025 figure came in at +1.6% year-on-year, compared to a forecast of +1.7% and the previous August reading of +1.6%. According to data from Investing.com, trader expectations suggested slightly stronger inflation, but the reality confirms that Italian price growth remains stuck in a tight range.

After touching 1.9% earlier this year, inflation has struggled to build any real momentum.

Chart Analysis: Weak Momentum Persists

Looking at the chart, inflation bounced back from lows near 0.6% in early 2024 and peaked around 1.9% in May 2025 before cooling off again. Since then, CPI has been trapped between 1.5% and 1.7%, with September fitting right into that pattern. This kind of stability points to sluggish consumer demand, easing cost pressures, and a broader eurozone environment where price growth just isn't taking off.

Key Drivers Behind the Data

Energy prices have cooled down significantly, with drops in oil and natural gas helping to keep headline inflation in check. Italian households are still being cautious with their spending, weighed down by high borrowing costs that make big purchases less attractive. And it's not just Italy - similar slowdowns across the eurozone suggest this is a region-wide trend rather than something unique to the Italian economy.

Market Implications

Subdued inflation gives the European Central Bank more room to pause or even consider easing monetary policy, which should support bond prices while potentially weighing on the euro. Markets are treating Italy's stagnant CPI as confirmation that the recovery remains fragile, with implications for both equity valuations and currency positioning heading into year-end.

Usman Salis

Usman Salis

Usman Salis

Usman Salis