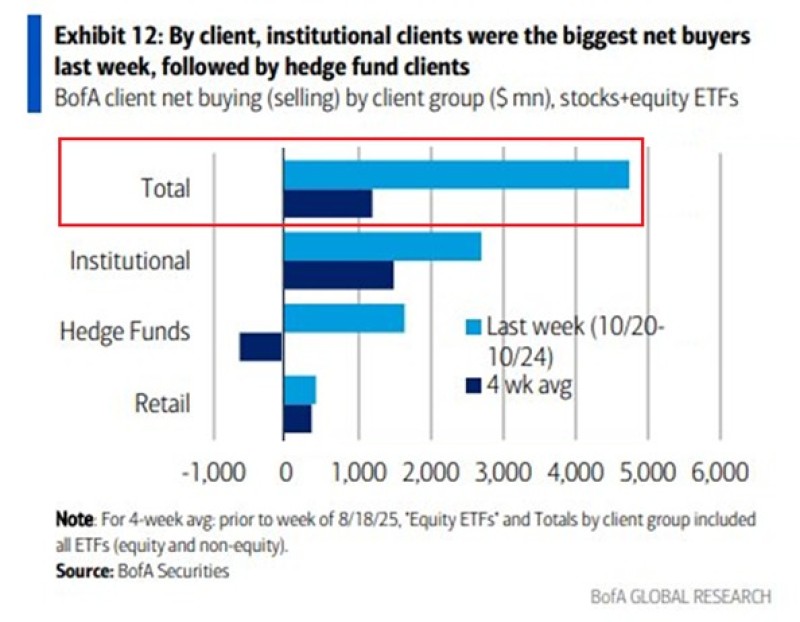

After weeks of cautious trading, money is rushing back into U.S. stocks. According to Bank of America Global Research, equity inflows hit $4.7 billion last week—the strongest showing since August. What makes this surge particularly noteworthy is that it's happening across the board: big institutions, hedge funds, and everyday retail investors are all buying again. That kind of broad-based participation often hints at a genuine shift in market sentiment.

Who's Buying and How Much

As The Kobeissi Letter pointed out on Twitter, institutional clients led the charge with $2.7 billion in purchases—a sharp reversal after selling in four of the past five weeks. Hedge funds, which had been net sellers for seven straight weeks, finally flipped and added $1.6 billion. Even retail investors stayed in the game for a third week running, contributing $400 million.

The buying wasn't limited to individual stocks either. ETFs pulled in a massive $3.8 billion—the most since November 2023—while single-stock purchases hit $900 million. That tells us both passive and active strategies are firing on all cylinders right now.

What's Behind the Optimism

A few things seem to be fueling this comeback. Bond yields have steadied, taking some heat off growth stocks. Corporate earnings have mostly beaten expectations, easing recession worries. And there's growing chatter that the Federal Reserve might pause rate hikes or even start cutting in 2026, which is music to investors' ears.

When institutional money, hedge funds, and retail buyers all move in the same direction like this, it's usually a bullish sign—at least in the short term. Historically, this kind of synchronized buying has kicked off rallies, especially when liquidity improves and uncertainty fades.

Of course, nothing's guaranteed. Whether this momentum lasts will depend on what economic data shows over the coming weeks and what the Fed signals next. But if inflation keeps cooling and earnings stay solid, we could be looking at the early stages of a stronger market recovery heading into 2026.

For now, though, the message is clear: investors are feeling optimistic again, and they're putting real money behind it.

Usman Salis

Usman Salis

Usman Salis

Usman Salis