India is demonstrating impressive monetary discipline while many global economies continue wrestling with persistent inflation. Recent data shows the country's inflation rate has dropped to just 1.5% year-over-year in September, with money supply growth staying at levels that support price stability. This careful balance indicates policymakers are successfully managing one of the most challenging global economic periods in recent memory.

India's Monetary Growth vs. Inflation

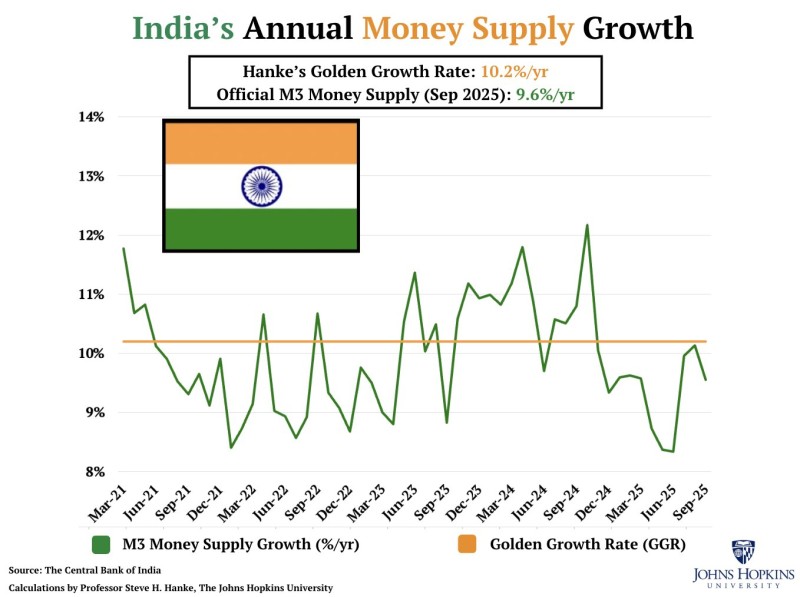

Economist Steve Hanke recently pointed out that India's official M3 money supply grew 9.6% annually, coming in slightly under his "Golden Growth Rate" of 10.2%. This benchmark has historically aligned with India's long-term inflation target of 4% per year.

The chart tracking India's M3 from 2021 to 2025 shows some volatility along the way, but current figures suggest money growth is well-managed and inflationary pressures are cooling off.

Why It Matters

Several factors are contributing to India's positive monetary picture. The Reserve Bank of India has maintained a measured approach, keeping inflation in check while still allowing room for economic growth. Meanwhile, falling global commodity prices - particularly for energy and raw materials - have taken some heat off domestic inflation. At the same time, robust household spending and steady investment flows continue driving economic activity. This mix not only keeps inflation stable but also reinforces India's standing as one of the more appealing emerging markets for investors right now.

Chart Insights

The data reveals three key takeaways: M3 money supply growth remains broadly consistent with the 10.2% long-term benchmark despite some ups and downs; inflation has declined sharply to 1.5%, showing that controlled monetary expansion is working; and the Reserve Bank's strategy appears credible, successfully balancing growth objectives with stability concerns.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah