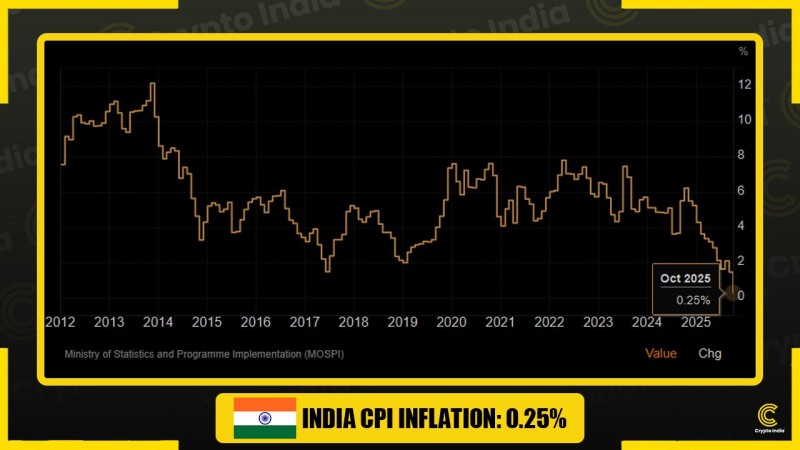

India just hit a historic inflation milestone. Fresh data from the Ministry of Statistics shows the country's consumer price index dropped to just 0.25% in October 2025—the lowest reading since 2012. After years of price volatility and periods where inflation topped 8%, this sharp decline marks a dramatic shift in the economic landscape.

What's Driving the Cooldown

This isn't the result of any single policy move or economic shift. Instead, several forces came together at just the right time to push inflation down this far.

Both global market dynamics and domestic conditions played crucial roles in creating this historic low. The combination proved powerful enough to override the inflationary pressures that had dominated previous years:

- Global commodity prices dropped: Weaker energy demand and falling crude oil costs eased import pressures and helped India's trade balance.

- Food prices stabilized: Good monsoon conditions and strong crop yields cooled food inflation, which hits Indian households hardest.

- Past rate hikes kicked in: The Reserve Bank's aggressive rate increases from 2022–2023 are now showing their full impact on price dynamics.

- Global disinflation rippled through: Lower inflation worldwide reduced input costs for India's export sectors.

Together, these factors pushed the CPI down to near-flat territory for the first time in over a decade—a level far below India's historical average and a clear break from the 4–6% range that prevailed for years.

Reading Between the Lines

Looking at inflation trends from 2012 to now tells an interesting story. After hitting double digits between 2012 and 2013, prices gradually settled into a more predictable pattern around 4–6%. But this latest plunge below the psychologically important 2% threshold is something different entirely. It could mean India's achieved exceptional price stability, or it might signal weakening consumer demand—and that's where things get tricky for policymakers.

When inflation drops this low, economists start watching for signs that spending and industrial activity are cooling too much. The data reflects success in managing post-pandemic price pressures without major disruptions, but it also raises questions about whether growth momentum can hold up. If people and businesses pull back on spending because they expect prices to fall further, that creates its own problems.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi