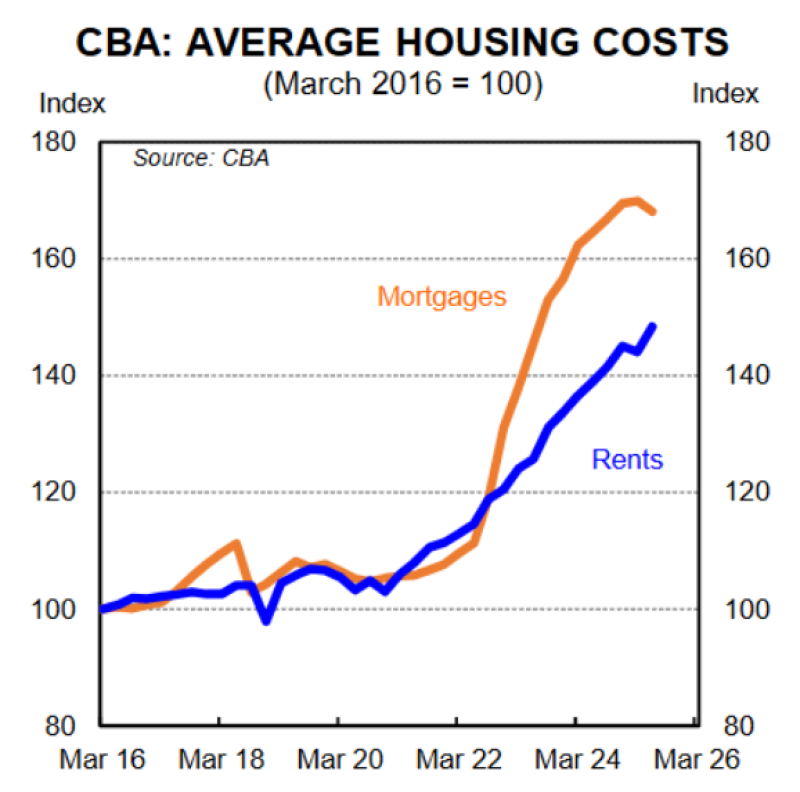

Housing has become one of the most sensitive components of inflation, yet not all housing costs are moving in the same direction. Recent data from the Commonwealth Bank of Australia shows a striking divergence: mortgage costs have skyrocketed since 2022, while rents have risen at a more moderate pace. This gap complicates how we interpret inflation data and could significantly influence interest rate policy decisions.

CBA Data Highlights the Growing Divergence

The Commonwealth Bank's analysis, which tracks costs from March 2016 as a baseline, reveals two distinct trends that diverged sharply after 2021. Analyst Tarric Brooker points out that this divergence has important implications for how we understand housing inflation.

Mortgage costs remained relatively stable until 2021, then began surging dramatically in 2022, eventually peaking above 170 on the index by early 2024 before easing slightly. Meanwhile, rents showed steady but slower growth, reaching around 145 by 2025. The turning point came as interest rate hikes filtered through the economy, causing mortgage costs to accelerate far beyond rent increases.

Why This Gap Matters for Policy

This misalignment between different housing costs creates significant challenges for policymakers. Brooker argues that the rental component used in official inflation calculations may not accurately reflect what people are actually paying for rent according to CBA's real-world data.

If the Consumer Price Index is overstating rent-driven inflation, it could give central bankers an exaggerated picture of housing stress across the economy. This distortion risks keeping interest rates unnecessarily high, which ironically puts even more pressure on mortgage holders who are already facing the steepest cost increases.

Understanding the Drivers

The divergence stems from fundamentally different market dynamics. Mortgages are directly tied to central bank interest rate decisions, explaining their steep and immediate rise when monetary policy tightened. Rental markets, however, respond to slower-moving factors like housing supply shortages, wage growth patterns, and population changes from migration.

This creates a policy blind spot where official inflation data might be responding to rental trends that don't match what's happening in real rental markets, potentially leading monetary policy astray.

Looking Forward

If mortgage costs begin to stabilize while rents continue their gradual climb, we might see this divergence start to narrow over time. However, the current mismatch raises fundamental questions about how accurately we're measuring housing inflation and whether current policy settings are appropriate given the real-world data.

When Data Meets Reality

This analysis highlights a crucial problem in economic policy: not all housing costs respond to the same factors or move at the same pace. While mortgages have soared due to interest rate hikes, rents have increased more moderately despite being elevated. For both investors and households, how central banks interpret and respond to this mixed housing data will largely determine the direction of interest rates and broader economic conditions in the coming months.

Peter Smith

Peter Smith

Peter Smith

Peter Smith