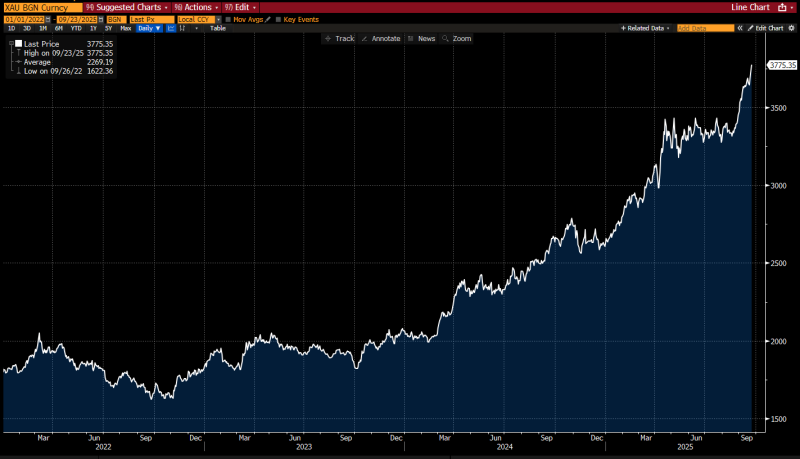

Gold prices hit $3,775 per ounce on September 23, 2025, marking their highest level ever and delivering the strongest annual performance since 1979. This surge reflects investor demand for safety, inflation concerns, and massive central bank purchases led by China.

Gold Hits Historic Levels Amid Central Bank Demand

The acceleration in gold buying gained momentum after last week's Federal Reserve meeting, which signaled rates could remain elevated longer than expected. As analyst Lisa Abramowicz noted, this triggered a rush into hard assets.

Central bank buying, particularly from China's People's Bank, has fundamentally altered market dynamics, creating sustained upward pressure.

Chart Analysis: A Relentless Multi-Year Climb

The chart shows gold's rise from 2022 lows around $1,622, building momentum through 2023 before accelerating in 2024. Breaking through $3,000 in mid-2025 marked a decisive shift, turning resistance into support. The uptrend has been remarkably consistent with higher highs and lows for three years. The surge above $3,700 reflects investor urgency about monetary policy uncertainty.

Why Is Gold Rallying So Strongly?

This rally is driven by several powerful forces. Persistent inflation has investors worried about purchasing power erosion, making gold's inflation hedge appeal stronger. Central banks worldwide, especially China's, have been buying aggressively to reduce dollar dependence. Geopolitical tensions around trade and energy have reinforced gold's crisis hedge reputation. The Fed's "higher for longer" stance has pressured stocks and bonds, pushing capital toward inflation-resistant assets like gold.

Can Gold Push Beyond $4,000?

With this kind of momentum behind it, many traders are eyeing the $4,000 mark as the next major target. If central banks keep buying at this pace and inflation remains stubborn, gold could easily venture even deeper into uncharted territory. That said, if inflation cools off faster than expected or the Fed starts hinting at rate cuts, we could see some profit-taking that tests support levels around $3,500.

Gold Reclaims Its Haven Crown

Gold's 2025 rally represents a fundamental shift in how investors and central banks view risk and diversification. With the biggest annual gain since 1979 locked in, the question isn't whether gold is strong, but how much further this momentum can carry it. Investors should expect volatility, but the long-term case for gold remains solid.

Peter Smith

Peter Smith

Peter Smith

Peter Smith