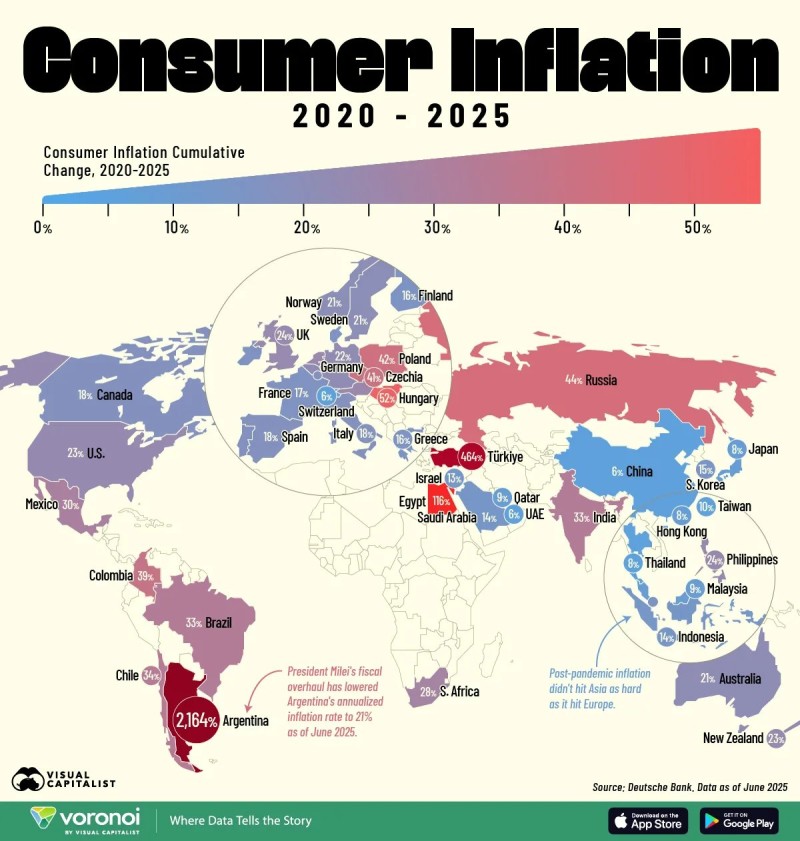

Between 2020 and 2025, inflation hit economies with wildly different force. Switzerland saw a modest 6% increase, while Argentina experienced a staggering 2,164% surge. For most developed nations, cumulative inflation ranged between 17% and 24%, meaning that unless your salary kept up, you're effectively poorer now than five years ago.

Post-pandemic supply chain chaos, energy crises, and currency instability created a patchwork of inflation experiences across continents.

A World Divided by Price Increases

Market strategist Nicolas Chéron recently highlighted this reality using Deutsche Bank data: if your wages haven't risen by at least 17% since 2020, your purchasing power has declined.

This isn't just theory - it's playing out differently across the globe. Here's how inflation varied across different regions from 2020 to 2025:

Europe:

- Switzerland: +6%

- France: +17%

- Germany: +22%

- UK: +24%

- Poland: +42%

- Russia: +44%

North America:

- Canada: +18%

- United States: +23%

- Mexico: +30%

Latin America:

- Brazil: +33%

- Chile: +34%

- Colombia: +39%

- Argentina: +2,164%

Asia-Pacific:

- China: +5%

- Japan: +8%

- India: +33%

- Australia: +21%

Europe felt inflation's sting hardest, with the Ukraine war and energy disruptions pushing Poland and Russia above 40%. Latin America painted a dramatic picture, with Argentina's hyperinflation of 2,164% standing as a stark reminder of what happens when monetary policy loses credibility. Asia-Pacific told a different story, where disciplined monetary policies helped keep price increases more contained.

What This Means for Your Money

If your income didn't grow faster than inflation, you lost ground. Cash sitting in savings accounts lost value, which is why investing became a necessity rather than an option. Stocks, real estate, commodities, and inflation-protected bonds offered ways to stay ahead of rising prices.

Official inflation figures don't always capture the full picture either. Housing costs, which hit many households hardest, often aren't fully reflected in standard measures. The inflation you actually experience may feel much higher than reported numbers.

Why Long-Term Investing Matters

The 2020-2025 inflation surge reinforced an old lesson: you can't just save your way to financial security anymore. Diversification across asset classes and regions helps cushion the blow. Real estate appreciates with inflation, stocks represent ownership in companies that can raise prices, and commodities often rise when currencies weaken.

In an inflationary world, standing still means falling behind. Building a diversified investment strategy isn't about getting rich quick - it's about not getting quietly poorer year after year.

Peter Smith

Peter Smith

Peter Smith

Peter Smith