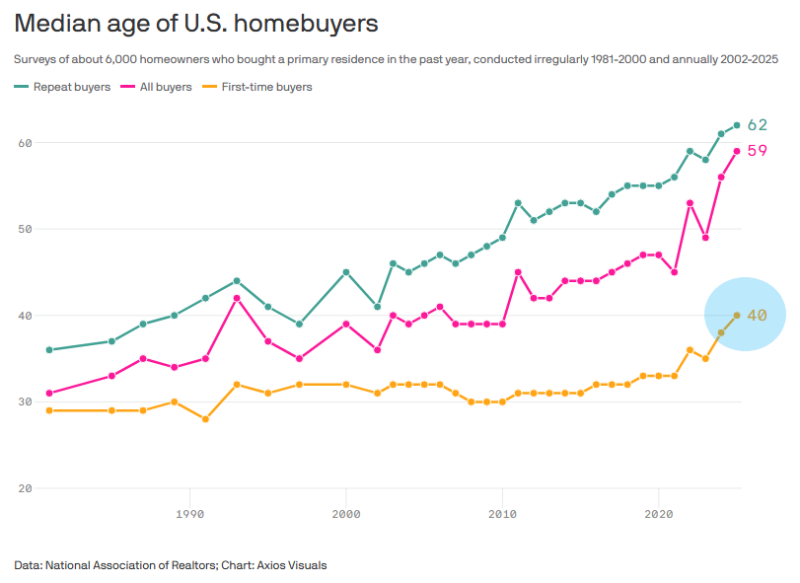

Buying your first home used to happen in your twenties or early thirties. Now it's becoming a midlife milestone. New data from the National Association of Realtors shows first-time buyers in the U.S. now have a median age of 40—the highest ever recorded. This shift reflects how expensive homes, high mortgage rates, and stagnant wages are pushing younger generations further from homeownership.

Chart Analysis: Four Decades of Rising Ages

NAR surveys of about 6,000 U.S. homeowners show a steady upward trend since the 1980s, with a sharp climb in recent years. According to Barchart analysis, first-time buyers stayed around age 30 for decades but jumped fast after 2020, hitting 40 this year.

All buyers now average 59, while repeat buyers have reached 62—both record highs. The post-pandemic spike shows homeownership is increasingly concentrated among older, more financially established demographics.

Economic Drivers Behind the Delay

Several forces are pushing homeownership out of reach for younger Americans:

- Mortgage costs have surged over the past two years, pricing millions out of the market

- Home prices remain high due to tight inventory

- Builders focus on bigger, pricier homes instead of entry-level options

- Younger buyers face student debt, rising rent, and stagnant wages

All of this makes saving for a down payment extremely difficult. People who might have bought homes in their late twenties are now waiting until their late thirties or forties.

What This Means for Society

The consequences go beyond delayed purchases. Getting into the market later means less time to build equity and wealth, deepening generational inequality. Older repeat buyers with cash or equity often outbid first-timers. This delay also affects other life decisions—starting families, planning for retirement, and where people can afford to live.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi