● In a recent post, Danny Dayan made a striking claim: the Federal Reserve has broken its own tools. Since 2010, the Fed has bought roughly $1.4 trillion in long-dated Treasuries (10+ years), with over $1 trillion coming since 2020 alone. That's more than 30% of everything issued during that stretch.

● Here's the problem. The Fed relies heavily on market-based inflation signals — especially TIPS breakevens — to reassure everyone that long-term inflation expectations are "anchored." But as Dayan points out, how reliable are those signals when the Fed owns such a huge chunk of the very bonds producing them? It's like grading your own test.

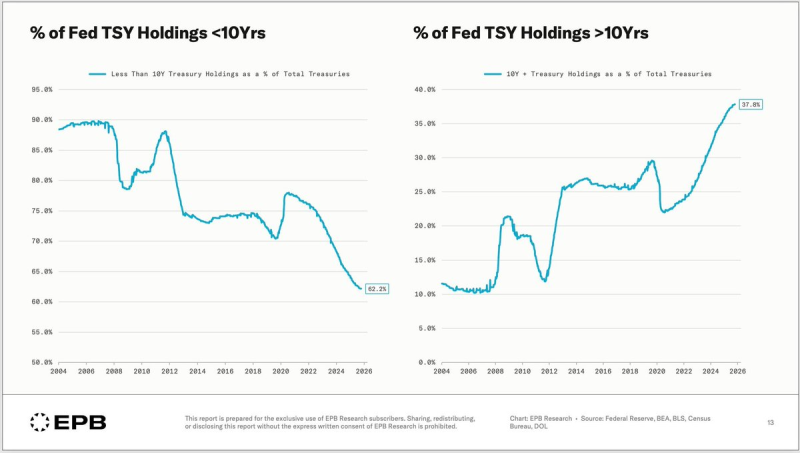

● Recent data from EPB Research paints the picture clearly. The Fed's holdings under 10 years have dropped to 62.2%, while those over 10 years hit a record 37.8% — the highest ever. This concentration drains liquidity, warps duration risk, and makes unwinding the balance sheet even trickier.

● What started as an emergency policy during the 2008 crisis and again in 2020 has quietly become permanent. The Fed is now a fixture at the long end of the curve, keeping rates low and possibly enabling runaway government borrowing in the process.

● As Danny Dayan put it bluntly: "The Fed has distorted the very market they use to assess inflation expectations." His skepticism is shared by a growing number of analysts who doubt whether traditional bond signals still mean what they used to.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova