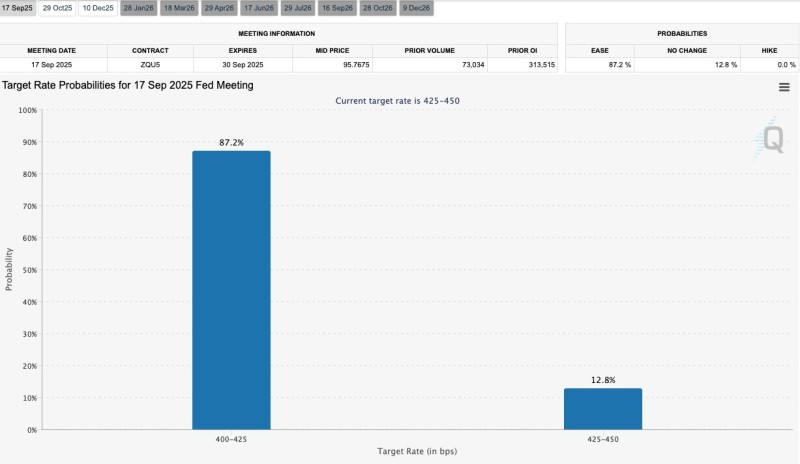

The latest PCE inflation data has sent a clear signal to traders, and as @SatoshiFlipper noted, the odds of a Federal Reserve rate cut have skyrocketed. According to CME FedWatch data, markets now price in an 87.2% chance of easing at the September 17, 2025 meeting. For investors across equities, crypto, and commodities, this could be the bullish trigger they’ve been waiting for.

Fed Rate Cut Probabilities – Numbers Tell the Story

The market has spoken, and it's loud and clear. Here's where things stand right now:

- 87.2% chance rates drop to the 400-425 basis point range

- 12.8% chance the Fed holds steady at current levels (425-450 bps)

- 0% chance of a rate hike (that ship has sailed)

This isn't just gradual market sentiment shifting - this is a dramatic pivot that happened almost instantly after the PCE data hit the wires. When markets move this decisively, it usually means something big is brewing.

Why Crypto and Risk Assets Care

Here's the thing about rate cuts - they're like rocket fuel for risk assets. When borrowing gets cheaper and money flows more freely, investors start hunting for yield in places like crypto and growth stocks. Bitcoin, Ethereum, and the broader altcoin market have historically loved these kinds of monetary policy shifts. It's the same story for tech stocks and commodities like gold.

Think about it this way: when the Fed cuts rates, they're essentially telling the market "we want more risk-taking and investment." For crypto traders, that's music to their ears.

What to Watch Before September

Don't get too comfortable just yet. While 87% odds are pretty convincing, we're still dealing with the Fed here - an institution that loves to keep markets guessing. Any curveball in the next inflation report or a surprise in jobs data could flip the script entirely.

Keep your eyes peeled for Fed officials' speeches and any hints about their thinking. Markets can be fickle, and what looks like a sure thing today might feel less certain tomorrow.

Peter Smith

Peter Smith

Peter Smith

Peter Smith