Europe just got some welcome news on the inflation front. Consumer prices across the EU rose just 2.1% last month, bringing the bloc tantalizingly close to the European Central Bank's 2% goal after nearly two years of stubbornly high inflation. With energy markets settling down and shoppers pulling back, October's numbers suggest the worst may finally be behind us.

Prices Steadily Returning to Normal

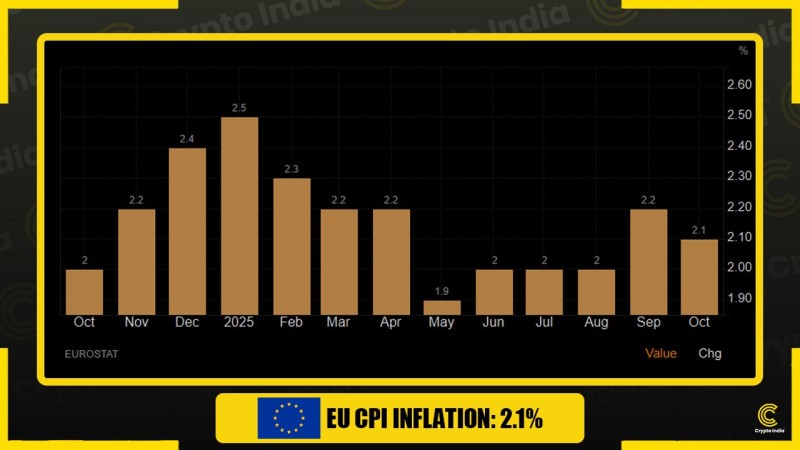

Eurostat's latest data shows how inflation has moved through the year, painting a picture of gradual improvement.

The month-by-month breakdown reveals a clear pattern of normalization, with price pressures easing in a controlled way rather than crashing suddenly:

- October last year: 2.0%

- Winter surge: climbed from 2.2% to 2.5%

- Spring cooldown: dropped back to 2.2%–2.3%

- May dip: hit 1.9%

- Summer plateau: held steady at 2.0% through June, July, and August

- September bump: ticked up to 2.2%

- October now: back down to 2.1%

The trend's pretty clear — after a winter peak, prices cooled through spring, stabilized over summer, saw a brief bump in early fall, and now they're easing again. It's the kind of controlled slowdown policymakers were hoping for.

What's Pushing Inflation Down

Energy's Finally Stable After the wild swings of 2022 and 2023, natural gas and oil prices have settled into a much more predictable range, taking serious pressure off headline inflation.

Shoppers Are Holding Back Higher interest rates are doing their job — people aren't spending as freely, which means less demand pushing prices up on everything from restaurant meals to new cars.

Supply Chains Are Back to Normal Shipping costs, factory delays, manufacturing hiccups — all those pandemic-era headaches have mostly disappeared, keeping goods prices in check.

The ECB's Still Keeping Things Tight Interest rates remain high enough to cool things down, even as talk of rate cuts starts to build.

Put it all together, and you've got inflation sliding toward that 2% sweet spot in a way that actually looks sustainable.

What This Means Going Forward

Rate Cuts Coming Soon? With inflation behaving itself for months now, analysts think the ECB might start cutting rates in early 2026 — assuming nothing goes sideways globally.

Market Reactions Lower inflation typically weakens the euro in the short run, while eurozone bonds become more attractive as rate-cut expectations grow stronger.

Real Benefits for Everyone This cooldown is good news across the board. Workers are seeing their paychecks go further, businesses can plan costs more easily, and governments have less fiscal pressure to deal with.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir