Oil markets might be setting up for a substantial move higher. A unique correlation pattern between crude oil prices and inflation expectations has entered territory that historically preceded strong rallies, presenting what could be an attractive entry point for patient investors.

Historical Pattern Suggests Bullish Setup

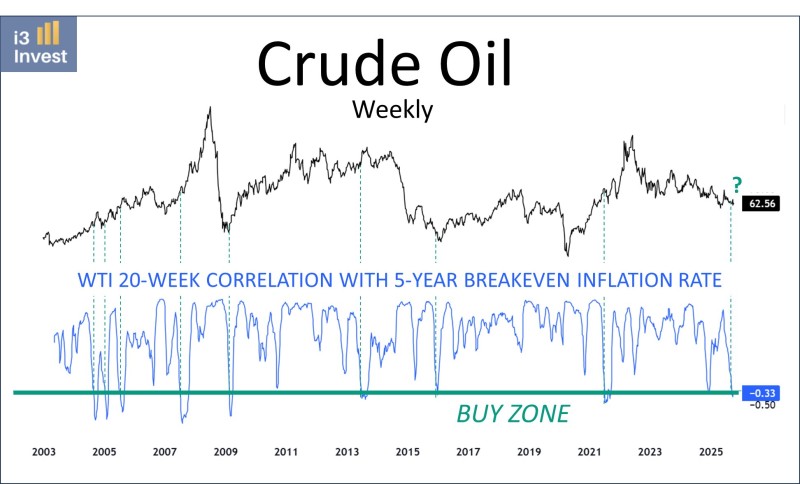

Market strategist Guilherme Tavares recently pointed out that the 20-week correlation between WTI crude oil and the U.S. 5-year breakeven inflation rate has fallen to deeply negative levels, hovering near –0.33. This puts it squarely in what historical data identifies as a "buy zone."

When this correlation has previously stayed below –0.35, oil posted positive returns 82% of the time over the following year, with average gains reaching 32%. Similar setups appeared in 2008, 2015, and 2020 - each time followed by meaningful recoveries.

What the Chart Reveals

Right now, crude oil is trading around $62.56, holding steady within a broad accumulation zone despite ongoing economic uncertainty. Meanwhile, the correlation indicator has dropped sharply into negative territory, mirroring patterns that have historically signaled the start of strong rallies. The disconnect between easing inflation expectations and oil's fundamental picture - steady global demand, managed OPEC+ supply, and persistent geopolitical tensions - suggests the commodity may be underpriced relative to its long-term drivers.

Why This Setup Matters

This divergence is significant because it reveals a market mispricing. While inflation concerns cool, the underlying fundamentals for crude oil remain constructive: demand recovery continues globally, supply remains disciplined, and geopolitical risks add a supportive backdrop. For investors focused on value and willing to look past near-term volatility, this environment may represent one of the more compelling opportunities in recent years.

A Strategic Entry Point

The data suggests crude oil is entering a historically favorable phase. With an 82% probability of gains and potential returns averaging over 30% based on past patterns, current levels could offer a rare chance for energy investors to position ahead of the next cycle. For those with a longer-term view, this might be the kind of setup worth paying attention to.

Peter Smith

Peter Smith

Peter Smith

Peter Smith