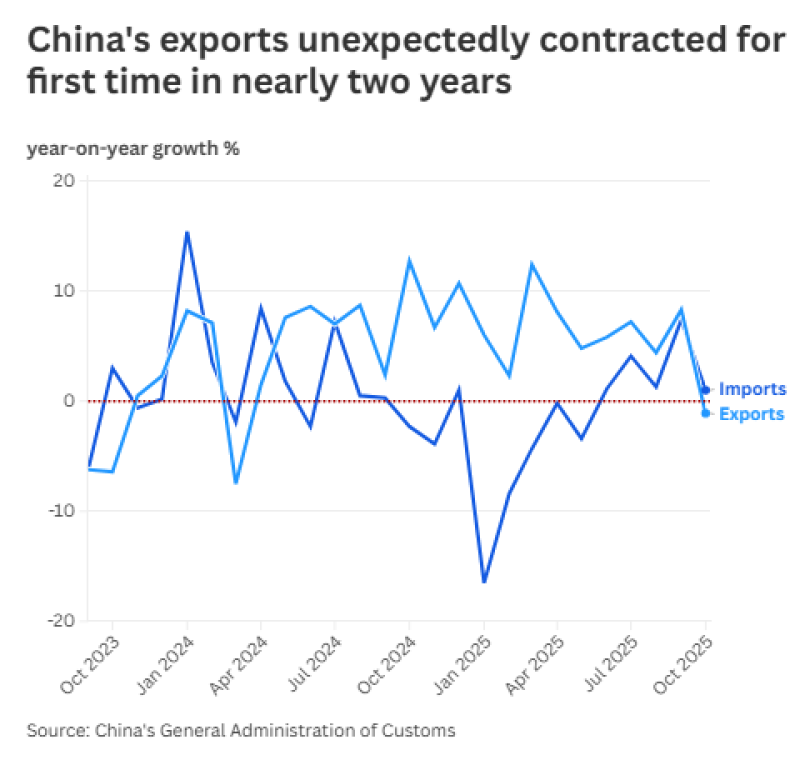

China's latest trade figures have delivered an unexpected warning: exports have fallen year-on-year for the first time in nearly two years. For a country that serves as the world's manufacturing engine, even a mild contraction can ripple through commodities, shipping, and international supply networks. The timing—heading into late 2025—adds weight to concerns that global momentum may be slowing more sharply than anticipated.

China's Surprise Export Contraction Signals New Stress in Global Trade

The downturn, highlighted in a recent update from Barchart trader, comes at a crucial moment for the global economy as demand cools, supply chains continue to diversify, and geopolitical tensions reshape trade flows. After months of fluctuating between low positive and negative growth, the latest reading confirms what many feared: Chinese export momentum has finally turned negative.

The chart tracking China's import and export growth rates from late 2023 to October 2025 shows exports crossing decisively below the zero threshold. Unlike previous episodes where sharp drops were followed by quick rebounds—like the steep decline near April 2025—this latest downturn comes after gradual weakening, suggesting a structural slowdown rather than temporary noise. Imports remain slightly above zero but are also softening, reinforcing signs of reduced domestic demand. Both lines point toward stagnation, with no upward reversal in sight.

What's Behind China's First Export Contraction in Almost Two Years?

Several forces are driving the downturn. Softening global demand is playing a big role—consumer and industrial activity in the U.S. and Europe has cooled, reducing orders for electronics, machinery, and manufactured goods. Companies continue shifting production toward Southeast Asia, India, Mexico, and Eastern Europe, while Western restrictions on Chinese technology are creating new barriers for exporters. Domestically, China's manufacturing PMIs have hovered near contraction territory for months, reflecting weaker factory output. Base effects from post-pandemic surge years also make current figures appear weaker than they are.

Why This Matters for Investors and Global Markets

The implications stretch across multiple markets. Lower exports often mean reduced demand for energy and industrial metals, putting pressure on commodity markets. A persistent trade slowdown could weaken the Chinese yuan, while companies deeply tied to Chinese supply chains—logistics firms, semiconductor suppliers, and industrial manufacturers—may face softer revenue. China may respond with stimulus measures like tax relief, export rebates, or monetary easing, which could determine whether this is a brief stumble or the start of a longer adjustment.

Usman Salis

Usman Salis

Usman Salis

Usman Salis