Rare earth elements have become the quiet battleground of 21st-century industrial power. These 17 metallic elements are essential to everything from smartphones and electric vehicles to wind turbines and military hardware. Today, one nation stands far above the rest in controlling these vital resources, and the implications stretch across economics, technology, and geopolitics.

China holds a commanding lead in rare earth reserves, controlling more than twice the amount of its nearest competitor. China holds an estimated 44 million metric tons of rare earth reserves, accounting for roughly 40% of the global total, based on U.S. Geological Survey figures from January 2025.

China's Unmatched Position

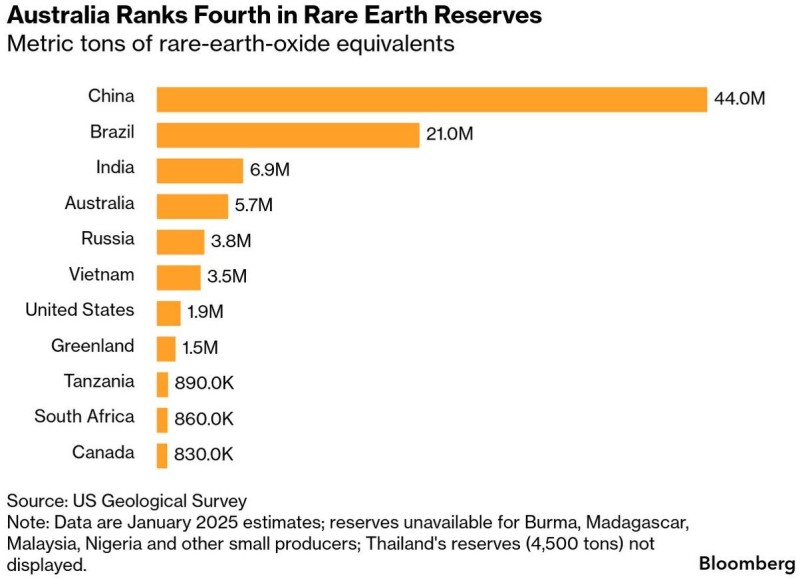

The numbers tell a stark story. According to recent data from Stock Sharks, China sits atop the chart with 44 million metric tons, dwarfing Brazil's 21 million tons in second place. India follows with 6.9 million tons, and Australia with 5.7 million. By comparison, the United States has just 1.9 million tons and Canada 830,000 tons, exposing a significant supply gap with profound strategic implications.

China's advantage extends beyond raw reserves. The country also controls the vast majority of global refining capacity, meaning even rare earths mined elsewhere often need processing in China. This dual dominance makes China indispensable to industries ranging from electric vehicle manufacturing and renewable energy to semiconductors and defense systems.

Why This Matters

Rare earth elements are the backbone of modern technology and the clean energy transition. Neodymium powers EV motors and wind turbines, europium enables LED screens, and lanthanum is crucial for batteries. Without these materials, much of today's technology simply wouldn't work. Industry estimates suggest demand could triple by 2035, making control over these resources a defining factor in economic competitiveness and national security.

China's near-monopoly has prompted urgent responses. Australia is positioning itself as a reliable alternative through companies like Lynas Rare Earths. Brazil's rapid ascent reflects growing ambitions driven by rich deposits and Western partnerships. The United States has introduced legislation to incentivize domestic production, yet remains heavily reliant on Chinese imports. Experts warn that breaking this dependence will require years of sustained investment in refining infrastructure and recycling technologies.

A New Frontier of Power

The clean energy transition has turned rare earths into strategic leverage. China's dominance ensures it remains central to global supply chains while granting considerable influence in negotiations involving technology, trade, and defense. For investors, this is driving interest toward non-Chinese producers and innovative extraction technologies. Yet for now, China's 44-million-ton lead means the rest of the world is playing catch-up in one of the most consequential resource competitions of our time.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah