Over the last few months, the New Zealand government has introduced and reviewed a new Online Casino Gambling Bill. Initially proposed on the 30th June this year, the bill aims to create a new regulatory environment around online gambling. In the past, the online casino market in NZ was largely unregulated, and offshore operators, such as those that can be found listed on Kiwislots, have plied their trade to NZ residents, with somewhere in the area of $700m being spent on online gambling annually.

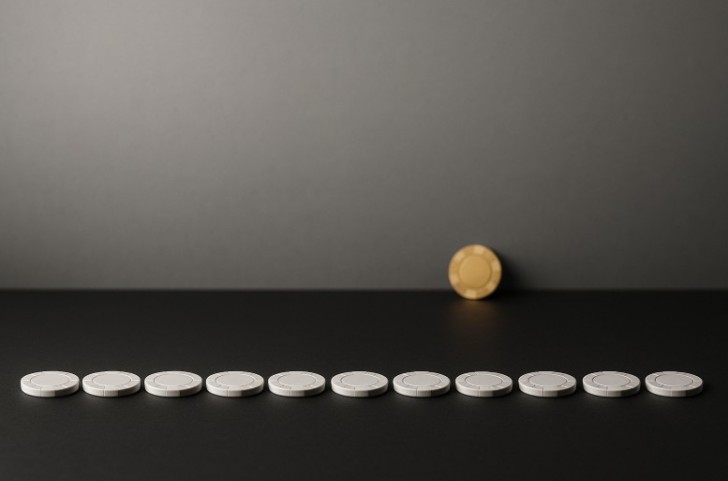

This bill will create 15 licenses for online casino platforms to be distributed, and will also contain rules for consumer protection, advertising and anti-money-laundering, which operators must adhere to. But will the bill realistically affect offshore operators? Let's take a closer look.

What The Bill Proposes To Do

We touched on the broad strokes of what the bill is intended to do; it is aimed at establishing a domestic online casino market and to stem the monetary flow out of the country to offshore operators. It includes tools for regulators to wield against operators that fail to adhere to it, and, in theory, will help to provide better protections to NZ players. It includes many of the same things that you might expect from other mature online gambling markets, such as what can be found in the UK. Things such as formal licensing criteria, harm minimisation tools, meeting anti-money-laundering criteria and the enforcement of strict advertising rules.

The bill will contain the provision for 15 licenses to be granted to casino operators, with the possibility for more licenses to be added in the future. The bill contains all of the relevant information for how operators can go about acquiring said licenses, which includes public expressions of interest, competitive bidding and a more formal application process. The limit of 15 operators is designed to be manageable both in terms of government oversight and also to give consumers options, but not so many options that they would become meaningless. The NZ government seems to believe that 15 operators is a sweet spot for enhancing both market opportunity and consumer protection.

The bill's proposed timeline, which seems to be on schedule at the time of writing, is that by mid-2026, in early July, the first of the licensed services should be available. The bill also includes a provision for offshore operators, those that acquire licenses, to pay an offshore gambling duty, on top of what they would otherwise be expected to pay. This is designed to narrow the advantageous margins that running an offshore platform provides over domestic operators.

What Will Be The Short-Term Impact for Offshore Operators?

In the short term, offshore operators will be faced with some tough decisions when the bill is enacted in 2026. They can:

- Give up on the NZ market and accept that the revenue from that market is forever lost to them.

- Apply and bid for an NZ license. For some operators, this might be as simple as submitting the forms and expressing their interest, then out-bidding any rivals. For others, they might need to radically restructure some of their software or processes in order to meet regulatory rules around know your customer, anti-money-laundering and harm-minimisation protocols.

- Continue to operate as an offshore platform and ignore the new NZ regulatory environment. With new enforcement options available to the NZ government, this is likely to prove damaging to growth and operators that choose this route will need to contend with sanctions, advertising bans and other enforcement tools leveraged against them by the NZ regulatory environment.

For some operators, the choice is all but made for them, with small returns coming from a market that has suddenly upped the amount it costs to be involved with; abandoning it will be much simpler and more attractive than compliance. Bigger operators are faced with the tougher choice: Is the market attractive enough that they will comply and dance to the regulators' tune, including the increased tax rate? Or will they decide that they will risk non-compliance, or even abandon the market entirely?

As we mentioned earlier, the NZ online gambling market is worth somewhere in the area of $700m annually, but with tighter regulations and higher taxes, will it be worth it for every operator to continue plying their trade?

How Will Players Be Impacted?

Players of online casino games in NZ seem to be clear winners in this situation. They should be seeing games and platforms with better consumer protections, more responsible gambling tools, better dispute-resolution, better customer support and even more provably-fair games.

With 15 licenses up for grabs, there should still be plenty of room for market competition. This is good because it means that operators will still need to compete and offer deals to attract players from their rivals. In single-operator regulatory environments, illicit offshore platforms are able to offer players much better deals, partly because there is no regulated competition to the single operator. Happily, this situation will not occur in the NZ market, thanks to the range of licenses available.

Final Thoughts

While the upcoming bill will see changes to the NZ online casino market, even those operators who do not comply will not disappear overnight. It is likely that the true state of the online casino market in NZ will not be readily apparent until some months, or maybe years, after the bill has passed and the licensed operators have been established.

With NZ players being offered better consumer protections, it seems likely that the illicit offshore market will dwindle, and those operators that are happy to toe the regulatory line will see the increased tax rate as a necessary evil in order to do business.

Peter Smith

Peter Smith

Peter Smith

Peter Smith