For years, “crypto is untraceable” has been one of the biggest myths in digital finance. But the recent $15 billion Bitcoin seizure tied to Southeast Asia’s “Prince Group” scam has blown that belief apart - and reminded the world that the blockchain never forgets.

It’s also a lesson for ordinary users and players: the same transparency that helped authorities track criminals can also protect honest gamblers, if they choose verifiable platforms. Resources like LuckyHat.com and its list of top Bitcoin casinos demonstrate how traceable, provably-fair systems now define the future of safe crypto gaming.

The Bust That Changed the Narrative

In October 2025, U.S. and U.K. enforcement agencies, working with Singapore and Thailand, announced the dismantling of the “Prince Group,” a crime syndicate that laundered stolen crypto through online gambling platforms and so-called “investment academies.” More than 130,000 BTC - worth roughly $15 billion - were seized.

The U.S. Department of Justice confirmed the bust in an October press release, describing it as one of the largest cross-border digital-fraud takedowns ever recorded.

According to reports from Wired and Al Jazeera, the group ran romance-investment frauds and “pig-butchering” rings, forcing trafficked workers to message victims around the world. What ultimately ended the operation wasn’t luck or an informant - it was on-chain forensics.

Blockchain analytics firms traced thousands of wallet hops, connecting “cold” storage addresses back to centralized exchanges and gambling sites. Once investigators found one wallet tied to a KYC-verified account, the whole network unraveled.

The Blockchain Paper Trail

Bitcoin transactions are public by design. Each coin carries a visible trail from the moment it’s mined to every address it touches.

That transparency, long marketed as a privacy risk, turned out to be the very reason investigators succeeded. Firms like Chainalysis and Elliptic used clustering algorithms and “taint analysis” to follow stolen BTC across wallets.

According to Chainalysis’s 2025 Crypto Crime Report and Elliptic’s blog on Prince Group sanctions, investigators identified clusters of wallets moving through gambling sites and OTC brokers.

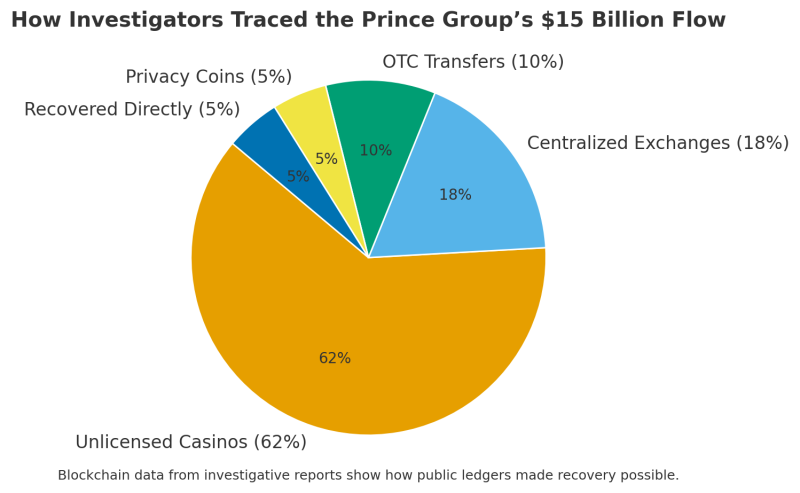

Their findings revealed that:

- More than 62 percent of the stolen funds moved through unlicensed gambling platforms.

- About 18 percent touched regulated exchanges that later froze assets.

- Only 5 percent reached privacy-focused coins such as Monero - the rest stayed traceable on Bitcoin or Ethereum.

It’s proof that even the largest criminal networks can’t hide on a transparent ledger forever.

- 62% through unlicensed casinos.

- 18% via centralized exchanges.

- 10% in OTC transfers.

- 5% converted to privacy coins.

- 5% recovered directly

The Data: Traceability Rising

The Prince Group case fits into a larger trend.

• Global crypto enforcement actions rose 280 percent from 2020 to 2025. Data compiled from OFAC and Treasury sanctions releases support the trend, with dozens of new designations targeting crypto-linked money-laundering networks.

• The value of seized digital assets surpassed $22 billion in 2025, according to Chainalysis.

• In the same period, reported laundering via gambling platforms fell 34 percent, as regulators began mandating wallet verification.

The irony? Bitcoin, once branded the “currency of the dark web,” is now one of the easiest assets to track.

What This Means for Players

For gamblers using cryptocurrency, traceability can sound intimidating - but it’s also a safety feature.

When you deposit or withdraw on a licensed Bitcoin casino, the transaction sits on a public ledger. That means:

- Provable fairness: outcomes can be cryptographically verified.

- Financial accountability: payments can’t vanish into hidden pools.

- Regulatory protection: suspicious activity is easier to flag and resolve.

Compare that to rogue casinos operating offshore, where anonymity isn’t privacy but a shield for fraud. The same visibility that exposed the $15 billion scam is what protects legitimate users today.

Why Transparency Doesn’t Mean Surveillance

Critics often equate traceability with government overreach, but there’s nuance. Blockchain data shows what happens - not who you are - unless linked to KYC systems.

In other words, privacy and transparency can coexist. A player can gamble anonymously on-chain while still benefiting from a verifiable audit trail that prevents manipulation or loss.

That’s the ethos behind the “provably fair” movement now reshaping crypto casinos: public randomness, auditable smart contracts, and open-source house edges.

A Safer Future for Crypto Gaming

The Prince Group’s downfall might mark a turning point. Law enforcement has proven that large-scale crypto crimes are traceable, and regulators are taking notice. As a result:

- Licensed crypto casinos are introducing independent audits.

- Exchanges are tightening wallet screening.

- Players increasingly prefer platforms that publish on-chain records.

Transparency isn’t just catching criminals, it’s building trust.

For the average player, the message is clear: choose platforms that embrace the blockchain’s visibility, not those that hide behind it.

Conclusion: The Ledger Never Lies

Crypto’s critics once said Bitcoin enabled crime because it was invisible. The $15 billion bust proves the opposite - the blockchain is a permanent spotlight. Every transaction leaves a mark, every scam a trail.

And in a world where transparency is power, the future of safe play belongs to those who build in public.

Peter Smith

Peter Smith

Peter Smith

Peter Smith