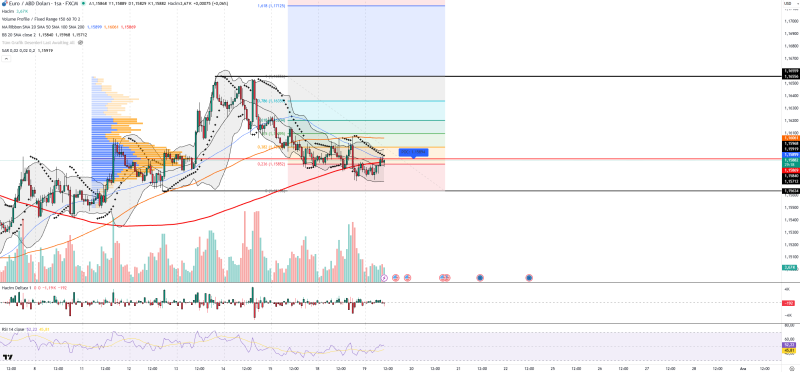

⬤ EUR/USD is struggling after last week's sharp decline, now moving sideways between 1.1580 and 1.1600. The hourly chart shows the pair can't push past the main downtrend line, and buyers just don't have enough strength right now. Every time price tries to climb, sellers step in and push it back down. The market feels stuck, but the bias clearly leans toward more weakness ahead.

⬤ The technical picture backs this up. Price keeps getting rejected at the 200-period moving average around 1.1591, which tells us buyers aren't strong enough to take control. There's a clear resistance zone between 1.1585 and 1.1595 where sellers keep showing up. Volume shows more action on the downside, while rallies barely get any support. The pair is trading near the lower Bollinger Band, and volatility is tightening—usually a sign something's about to break. Support sits at 1.1580, 1.1543, and 1.1517, with resistance at 1.1595, 1.1601, and 1.1635.

⬤ Momentum indicators aren't helping either. RSI is hovering between 45 and 52, which shows buying energy is fading fast. The Parabolic SAR is still on the sell side, confirming the downtrend hasn't reversed. As long as EUR/USD stays below the trendline and 1.1600, more downside pressure looks likely.

⬤ The bigger picture isn't much better. Recent euro zone data hasn't been impressive, while the dollar stays firm with the DXY index holding strong. Risk sentiment remains cautious, which keeps limiting any bounce attempts. What happens next depends on whether the pair can finally break out of this tight range or if fresh dollar strength sends it toward lower support levels.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah