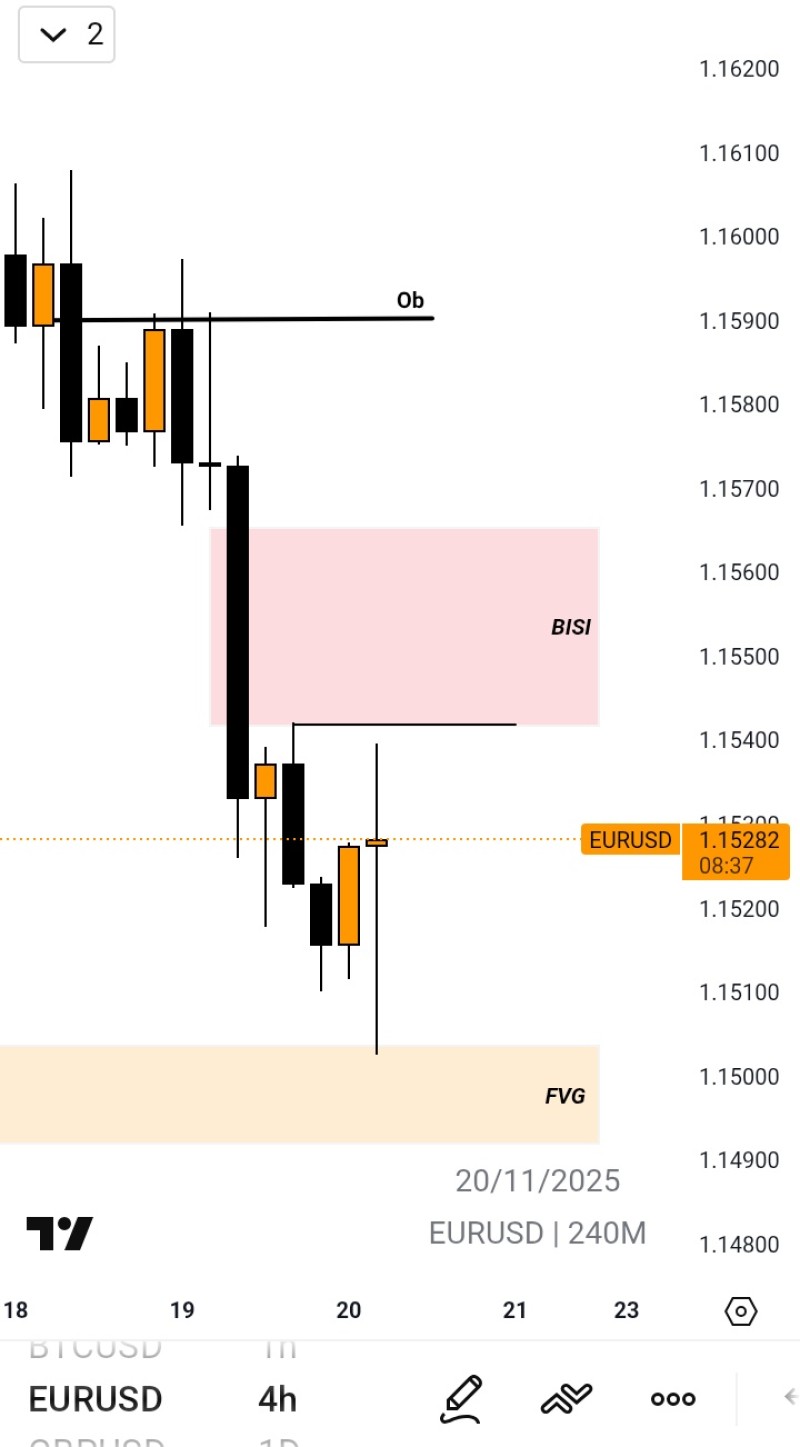

⬤ The 4-hour EUR/USD chart reveals a bearish imbalance zone sitting overhead while price hovers around 1.1528, just beneath an order block near 1.1590. The structure displays several supply and gap zones that traders are watching closely after the recent drop.

⬤ The bearish imbalance stretches from roughly 1.1540 to 1.1560, created by a quick selloff. EUR/USD tried pushing back into this area but couldn't hold above it, leaving the zone untouched. The order block around 1.1590 also remains in play as resistance. Down below, there's a fair value gap sitting under 1.1500 that hasn't been filled yet, which could pull price lower if selling picks up again. The long wick on the latest candle shows quite a bit of back-and-forth trading in this range.

⬤ Price movement between 1.152 and 1.153 points to a temporary pause after the earlier sharp decline. Several lower peaks have formed below the imbalance area, showing buyers haven't taken charge yet. Meanwhile, repeated wicks toward the bottom of the range indicate some buying interest at current support levels. With EUR/USD squeezed between the overhead imbalance and the lower gap, the next move will likely depend on which zone gets tested first.

⬤ This setup matters because EUR/USD is caught between two key levels that often drive momentum in major pairs. How price reacts to either the zone above at 1.154-1.156 or the gap below 1.150 could determine near-term direction and shape broader views on dollar strength and euro stability as the pair approaches these pivotal areas.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir