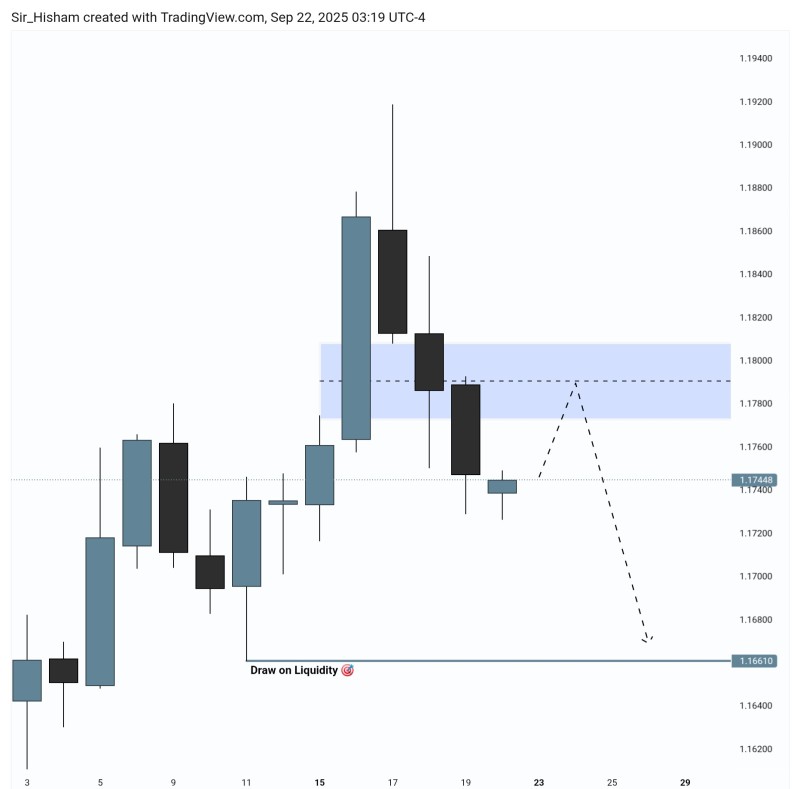

Here's the thing most traders miss: markets don't move because of textbook patterns. EURUSD just gave us three explosive candles upward, and now it's stalling right where you'd expect - classic algorithmic behavior.

The pair is sitting at 1.1744, bumping its head against that 1.1780-1.1800 resistance zone. The smart money knows exactly where the stops are sitting, and they're likely planning their next move around the liquidity pool down at 1.1660.

What the Charts Are Screaming

As Sir Hisham pointed out, it's all about algorithms hunting liquidity. Those three expansion candles? They're textbook exhaustion signals. You rarely see momentum like that without some kind of pullback following. The resistance zone between 1.1780-1.1800 is acting like a brick wall, and for good reason - that's where the supply is stacked up. Meanwhile, 1.1660 is flashing like a neon sign for liquidity hunters. The recent long upper wicks near 1.1880 tell the whole story - buyers tried to push higher but got absolutely crushed.

Why This Setup Makes Perfect Sense

The dollar's been flexing lately thanks to the Fed's hawkish stance, while Europe keeps delivering disappointing data. Growth concerns across the Eurozone aren't helping the euro's cause either. But here's the kicker - the market always seeks efficiency. Those liquidity imbalances need to get filled, and 1.1660 is sitting there like a magnet.

The bearish bias is pretty clear unless EUR/USD can somehow muscle above 1.1800 and actually hold it. That gives traders two clean plays: either wait for a bounce into that resistance zone to short, or just ride the momentum down toward the liquidity target. If you're going short, keep your stops tight above 1.1800 - false breakouts love to hunt stop losses before reversing.

Peter Smith

Peter Smith

Peter Smith

Peter Smith