The EUR/USD pair has caught traders' attention this week as it builds impressive bullish momentum following a strong bounce from key support zones. After weeks of sideways consolidation, the euro is finally showing signs of life against the dollar, with technical indicators aligning for what could be a significant upward move.

Market participants are closely watching whether this rally has enough steam to break through critical resistance levels that have capped previous advances. The current price action suggests we might be on the verge of a breakout that could reshape the near-term outlook for this major currency pair.

EUR/USD Shows Strong Bullish Structure

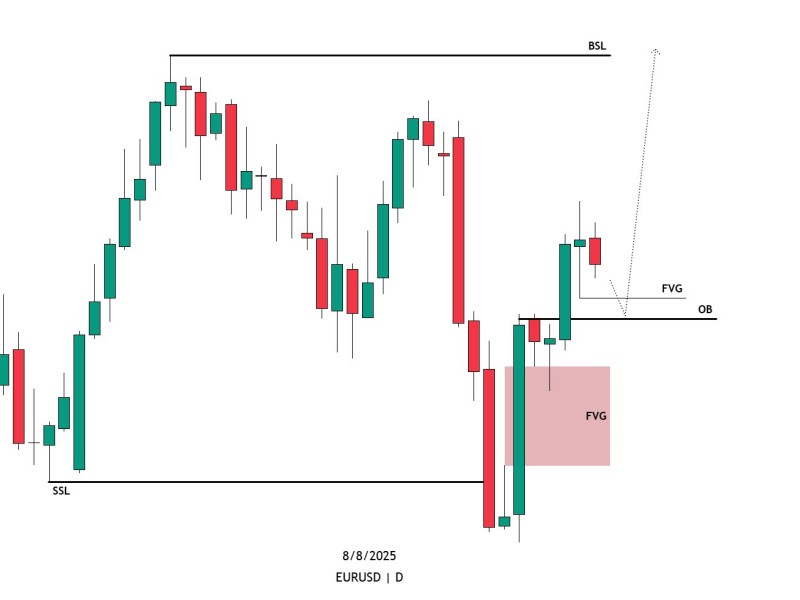

The EUR/USD daily chart reveals compelling bullish momentum after bouncing sharply from the key sell-side liquidity zone. This powerful rally smashed through the previous fair value gap and created a solid bullish order block, signaling genuine buying pressure in the market.

Bulls are now laser-focused on the buy-side liquidity level - essentially the previous swing high that's acting as the next major resistance. Price action hints at a possible short-term pullback toward the fair value gap area before pushing higher, which could give traders a sweet entry opportunity.

Critical Levels Traders Are Watching

The current setup shows clear support at the order block and nearby fair value gap zone, which could act as a springboard for the next leg up. Meanwhile, resistance sits firmly at the buy-side liquidity level - the main target bulls need to crack.

The bias remains bullish as long as price stays above both the order block and sell-side liquidity levels. Market participants are keeping a close eye on whether any retest of the order block area will hold firm, as this could trigger an explosive move higher.

What's Next for EUR/USD?

If this bullish scenario unfolds as expected, EUR/USD could punch through the buy-side liquidity zone and establish fresh highs in the upcoming sessions. However, a clean break below the order block would seriously damage the short-term bullish outlook and put the sell-side liquidity area back in play.

Right now, the stars are aligning for the bulls - market structure, liquidity targets, and technical zones all point toward potential upside momentum continuing.

Usman Salis

Usman Salis

Usman Salis

Usman Salis