The euro is facing renewed pressure against the dollar after struggling to hold above 1.1700. Price action shows sellers firmly in charge, with the pair hovering near its lowest levels since early autumn. The downtrend appears far from finished as technical and fundamental factors align bearishly.

Chart Analysis: Resistance at FVG Zones

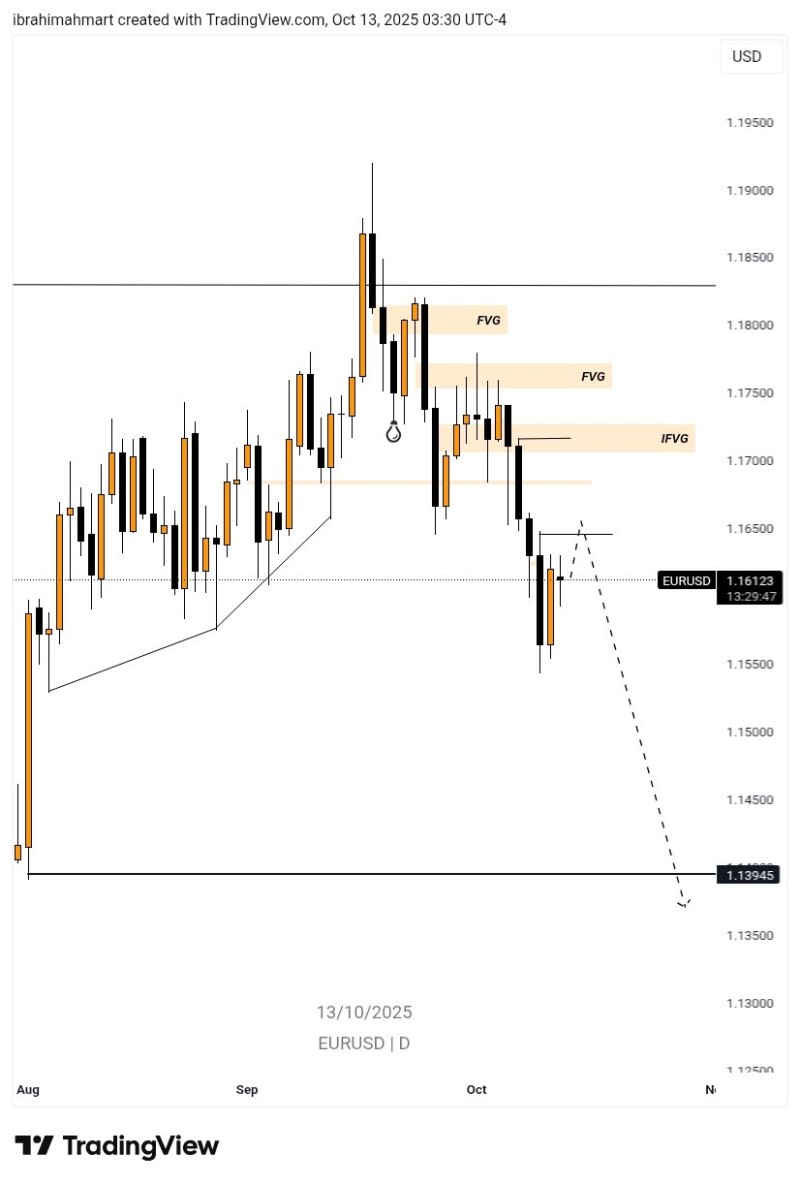

According to IB-forex trader's recent analysis, the daily chart reveals a compelling bearish structure. The pair's rejection from 1.1850 triggered a swift reversal, while unfilled Fair Value Gaps between 1.1700–1.1800 continue capping rallies and acting as overhead resistance.

The technical setup projects a potential slide toward 1.1394, a significant support zone that might attract buyers if reached. Without a decisive break back above 1.1700, the bearish case stays intact.

Macro Drivers Supporting Dollar Strength

The Fed's commitment to keeping rates elevated contrasts sharply with the ECB's more cautious approach, creating policy divergence that favors the dollar. Meanwhile, weak business activity and sluggish GDP growth across the eurozone weigh on the single currency. Global uncertainty continues driving safe-haven flows into the greenback, adding further downside pressure on EUR/USD.

What Traders Should Watch

A daily close below 1.1600 could unlock the path toward 1.1390, while reclaiming 1.1700 would challenge the bearish narrative and shift attention back to upper resistance zones. Upcoming U.S. inflation prints and ECB policy signals will likely drive the next wave of volatility.

Atman Rathod

Atman Rathod

Atman Rathod

Atman Rathod